Several directors and senior executives of Changgao Group have reduced their holdings by 7,173,700 shares.

() Announce that the actual controller, chairman Mr. Ma Xiaowu, directors Mr. Ma Xiao, Mr. Lin Lin, Ms. Liu Jiayu and chief financial officer Mr. Liu Yunqiang of the company plan to reduce some of the company’s shares by centralized bidding or block trading within 6 months (from November 1, 2021 to April 30, 2022) after 15 trading days from the date of the announcement of the reduction.

As of the date of this announcement, the above-mentioned personnel have reduced their holdings by more than half, with a total of 7,173,700 shares of the company.

Dongpeng Holdings has not implemented share repurchase yet.

() Announcement, as of January 31, 2022, the company has not implemented share repurchase.

Huang Qiang, an executive of Guibao Technology, reduced his holding of 9,000 shares of the company.

() Announcement was issued. As of the disclosure date of this announcement, Mr. Wang Youqiang and Mr. Li Song did not reduce their holdings of the company’s shares, and Mr. Huang Qiang reduced his holdings of 9,000 shares of the company during this period.

Qiaqia Food has spent 30.008 million yuan to buy back 547,800 shares.

() Announcement was issued. As of January 31st, 2022, the company repurchased 547,800 shares of the company by centralized bidding through the special securities account for share repurchase, accounting for 0.108% of the company’s current total share capital. The highest transaction price was 59.56 yuan/share, the lowest transaction price was 520,775 yuan/share, and the total turnover was 30,008,000 yuan.

Jingquanhua bought back 106,000 shares at a cost of 1,265,100 yuan.

() Announcement was issued. As of January 31, 2022, the company repurchased 106,000 shares of the company by centralized bidding, accounting for about 0.059% of the company’s current total share capital. The highest transaction price was 12.11 yuan/share, the lowest transaction price was 11.80 yuan/share, and the total transaction amount was 1,265,100 yuan (excluding transaction costs). The repurchase of the above-mentioned companies meets the requirements of relevant laws and regulations and conforms to the established repurchase plan.

Kelun Pharmaceutical has repurchased 2,216,600 shares at a cost of 40,005,100 yuan.

() Announced that as of January 31st, 2022, the company used its own funds to implement this repurchase plan, and repurchased shares by centralized bidding through the special securities account for stock repurchase. The cumulative number of repurchased shares was 2,216,600 shares, accounting for 0.1555% of the company’s total share capital. The highest transaction price was 18.25 yuan/share, the lowest was 17.85 yuan/share, and the transaction amount was 40,005,100 yuan (.

Wanbangde repurchased 4,139,200 shares at a cost of 50,953,500 yuan.

() Announcement was issued. As of January 31st, 2022, the company repurchased shares by centralized bidding, and the cumulative number of repurchased shares was 4,139,200 shares, accounting for 0.67% of the company’s total share capital. The highest transaction price was 12.64 yuan/share, the lowest was 9.69 yuan/share, and the transaction amount was 50,953,500 yuan (excluding transaction costs).

Zhang Shaoyao and Cheng Yanan, directors of Xingqi Ophthalmology, did not reduce their holdings of the company’s shares, and the period of reduction expired.

() Announcement was issued. On February 7, 2022, the company received the Letter of Notice on the Expiration of the Share Reduction Plan issued by Mr. Zhang Shaoyao, Director, Deputy General Manager and Secretary of the Board of Directors, and Ms. Cheng Yanan, Director and Chief Financial Officer respectively. As of the disclosure date of this announcement, the period of the reduction plan of Mr. Zhang Shaoyao and Ms. Cheng Yanan has expired. From July 21, 2021 to the disclosure date of this announcement, Mr. Zhang Shaoyao did not reduce his shares in the company in any way. From July 21, 2021 to the disclosure date of this announcement, Ms. Cheng Yanan did not reduce her shareholding in the company in any way.

Yingke Medical: It plans to invest 300 million yuan to invest in Wuxi Shangxian Lake Boshang Investment Partnership.

() On the evening of February 7th, it was announced that the company planned to sign a partnership agreement with Jiangsu Boshang, etc. to invest in Wuxi Shangxian Lake Boshang Investment Partnership (Limited Partnership) with its own funds of 300 million yuan. The total subscribed capital of the partnership enterprise is 6 billion yuan, focusing on the target companies and asset portfolios in the fields of new generation information technology, advanced manufacturing, medical and health care, consumer technology and other scientific and technological innovations.

The construction and restoration consortium won the bid for the project of 317 million yuan.

On February 7th, () (SZ300958) issued an announcement, and the company received the Notice of Winning Bid from Tianjin Beichen District Land Consolidation Center and Tianjin Pan Asia Engineering Consulting Co., Ltd., informing the consortium formed by the company and Zhongshui North Survey, Design and Research Co., Ltd. to win the bid for the dolphin rubber plot restoration and treatment project, with a bid amount of about 317 million yuan and a construction period of 18 months from the date of signing the contract. Since 2022, the construction engineering restoration has successively won the bid for Tianjin Dolphin Rubber Plot Restoration Project and Yancheng Lianfu Petrochemical Co., Ltd. West Plant Plot Restoration Project, with a total contract amount of about 346 million yuan, laying a good foundation for sprinting the business target in 2022.

The actual controller of construction repair is Beijing State-owned Assets Supervision and Administration Commission (SASAC), which landed on GEM in March 2021, and is the first concept stock in the A-share market that is mainly engaged in environmental repair business. As one of the earliest companies specializing in environmental restoration services in China, the construction engineering restoration after listing is accelerating the construction of comprehensive environmental restoration service layout.

A few days ago, the 2021 Science and Technology Promotion Award of China Academy of Sciences was announced, and the scientific research team of "Key Technologies and Applications of Industrial Contaminated Site Restoration" participated in the construction project restoration successfully won the award. This is after winning the 2021 environmental technology progress award, the scientific and technological innovation strength of construction repair has once again been recognized by the authority. Supported by the scientific and technological service capabilities of leading industries, the company has a strong momentum to accelerate the value transformation of the environmental restoration industry chain.

Relying on the high market share in the industry and the resource integration advantages of state-owned assets, the industrial chain layout of construction and restoration is stable and efficient. In 2021, the first batch of six "Environmental Hospital" service model pilot projects in Shandong Province were officially approved, and two projects, "Qingdao Environmental Hospital" and "Qilu Cloud Environmental Hospital", which were jointly declared for construction and restoration, were successfully selected, deepening model innovation in the field of remediation of contaminated sites with first-Mover advantages, and providing environmental policy consultation, diagnosis of environmental problems, system solutions, investment and financing of engineering construction, engineering design and construction, commissioning and operation for the government, enterprises and the public. At the same time, the company established an emergency disposal center for contaminated soil and groundwater in Yanziji New Town, Nanjing, explored the path of productization of contaminated soil, systematically solved the problem of regional pollution prevention and control, and opened up the market space for environmental restoration and operation.

Focusing on the "14th Five-Year Plan" of the country and the goal of carbon neutrality in peak carbon dioxide emissions, construction and restoration have frequently fallen into the business direction of ecological restoration. At the Global Coastal Forum, the company reached a strategic cooperation with Jiangsu Huanghai Wetland Research Institute to jointly build an experimental base for wetland purification and restoration, carry out research and development of key technologies and tackle key scientific problems, and make classified policies around different characteristics and governance needs of river and lake wetlands, coastal wetlands and urban wetlands, so as to scientifically promote the landing of wetland restoration projects. In Kunming, Yunnan Province, the project of comprehensive management of abandoned open-pit mines in the Yangtze River Economic Belt in Yunnan Province was undertaken for construction engineering restoration. Based on the achievements of material research and development, phosphogypsum was explored for soil improvement and pit filling, and ecological restoration and solid waste disposal were combined to realize the transformation of ecological benefits and economic benefits, and a model of "solid waste utilization+mine restoration" was created.

Research reports issued by many institutions are optimistic about the prospects of soil remediation market. Huajin Securities once predicted that the total market space in the three major areas of industrial contaminated site remediation, soil remediation in mining areas and farmland remediation could reach several trillion yuan in the future. (Reporter/Xiang Yantao)

Huada Gene: COVID-19 antigen self-test products have obtained EU CE access qualification.

At noon on February 7th, () announced that the COVID-19 antigen self-test product of BGI Europe A/S (referred to as "European Medicine"), a wholly-owned subsidiary of the company, had recently obtained the EU CE certificate.

According to BGI, COVID-19 antigen self-test products need no testing equipment, and have the characteristics of easy operation and quick results, which is convenient for individuals and families to quickly test Covid-19, and can better meet the needs of home detection and prevention of epidemic situation in various countries. Immunoassay is a traditional and mature detection technology, but its production system construction and quality optimization work test the technical accumulation and operation ability of the enterprise. The company’s COVID-19 antigen self-test product obtained the EU CE certificate this time, which indicates that the performance of the company’s immunoassay product has been recognized by the official organization, which is an important progress for the company to build a high-medium-low-flux product system in the field of infection prevention and control, and is of great significance for promoting the multipolar development of the company’s infection prevention and control business products.

Qi zhou, director of Fengxing Co., Ltd., has not reduced his shareholding, and the reduction period has expired.

() It was announced that qi zhou, the director of the company, did not reduce his shareholding in the company during this reduction plan. As of the date of this announcement, the period of its reduction plan expires.

Changyuan electric power subsidiary plans to expand the engineering chemical water system and the EPC project of zero wastewater discharge in the whole plant.

() Announcement was issued. On January 29th, 2022, the company received the Notice of Winning Bid (Shenhua Engineering Zhong [2022] No.00197) issued by the tendering agency () International Engineering Co., Ltd., and determined that Guoneng Langxinming Environmental Protection Technology Co., Ltd. (hereinafter referred to as Guoneng Langxinming) was a wholly-owned subsidiary of Guoneng Changyuan Jingzhou Thermal Power Co., Ltd. (hereinafter referred to as Jingzhou Company).

The EPC general contracting project of the 2×350MW expansion project of Jingzhou Thermal Power Plant Phase II of Changyuan Electric Power Co., Ltd. can realize raw water treatment and meet the water demand of the unit after the unit is officially put into use, and at the same time realize the cascade utilization of water resources without desulfurization wastewater discharge, and finally achieve the goal of zero desulfurization wastewater discharge.

Guanzhong Ecology: The consortium won the bid of 319 million yuan for gaoqing county urban and rural greenway network project.

() Announced that the consortium formed by the company and Photosynthetic Garden is the first successful candidate for the urban and rural greenway network project in gaoqing county. On January 29th, the company received the Notice of Winning the Bid for Construction Project from the tenderee and the tendering agency, with a bid price of 319 million yuan and a construction period of 730 (calendar days).

The winning project belongs to the company’s main business. If the company can sign a formal project contract and implement it smoothly, it will have a positive impact on the company’s operating performance and will not affect the company’s operating independence.

New Beiyang bought back 2.703 million shares at a cost of 23.0809 million yuan.

() Announced that as of January 31, 2022, the company had repurchased 2.703 million shares by centralized bidding through the special securities account, accounting for 0.4060% of the company’s total share capital as of September 30, 2021. The highest transaction price was 9.07 yuan/share, the lowest transaction price was 7.92 yuan/share, and the total amount paid was 23.0809 million yuan (excluding transactions)

Shandong Mining Machinery bought back 10 million shares at a cost of 21,893,100 yuan.

() Announcement was issued. As of January 31st, 2022, the company repurchased 10,000,800 shares of the company by centralized bidding through the special securities account for share repurchase, accounting for 0.56% of the company’s total share capital. The highest transaction price was 2.26 yuan/share, and the lowest transaction price was 2.1 yuan/share, and the total amount paid was 21,893,100 yuan (excluding transaction costs).

Cheng Zongyu, the controlling shareholder of Mingjiahui, reduced his holdings by 11,223,100 shares in a block trade.

() It was announced that Mr. Cheng Zongyu, the controlling shareholder, did not reduce his shares by centralized bidding, and the implementation period of his block trading and centralized bidding plan for reducing his shares has expired, in which the block trading reduced his holdings by 11,223,100 shares, accounting for 1.71%.

Tang Renshen has spent 62.967 million yuan to buy back 9.8937 million shares.

() Announcement was issued. As of January 31st, 2022, the company repurchased 9,893,700 shares of the company by centralized bidding through the special securities account for share repurchase, accounting for 0.82% of the company’s current total share capital. The highest transaction price was 7.33 yuan/share, the lowest transaction price was 5.65 yuan/share, and the turnover was 62.967 million yuan.

Haisike: Application for registration of new indications of cyclophenol injection was accepted.

() On the evening of February 7th, it was announced that the application for registration of new indications of innovative drug cyclophenol injection by Liaoning Haisike, a wholly-owned subsidiary, was accepted; Cyclophenol injection is a brand-new intravenous anesthetic developed by the company with independent intellectual property rights. In addition, the company’s innovative drug HSK31858 tablets were approved to carry out clinical trials for "lower respiratory diseases caused by bronchiectasis and acute lung injury/acute respiratory distress syndrome"; The innovative drug HSK31679 was approved to carry out the clinical trial of "intended to be used to treat adult primary hypercholesterolemia".

Haisike obtained the Notice of Approval for Clinical Trials of innovative drug HSK31858 tablets.

Haisike announced that the company had recently obtained the Notice of Approval for Clinical Trials of Drugs issued by National Medical Products Administration Drug Evaluation Center. After examination, HSK31858 tablets accepted in November 2021 met the relevant requirements for drug registration, and it was agreed that this product could be used for clinical trials of "lower respiratory diseases caused by bronchiectasis and acute lung injury/acute respiratory distress syndrome".

It is reported that HSK31858 tablet is an oral, potent and highly selective small molecule inhibitor of 1(Dipeptidyl Peptidase1,DPP1) independently developed by the company, and it is intended to be used for treating bronchiectasis and lower respiratory diseases caused by acute lung injury/acute respiratory distress syndrome.

Superstar Technology repurchased 6,673,800 shares at a cost of 203 million yuan.

() Announcement was issued. As of January 31st, 2022, the company repurchased 6,673,800 shares of the company by centralized bidding, accounting for 0.5837% of the company’s total share capital. The highest transaction price was 3.270 yuan/share, the lowest transaction price was 2.483 yuan/share, and the total used funds were 203 million yuan (excluding transaction costs).

Chen Huashen, supervisor of Xuedilong, has not reduced his shareholding for more than half of the time.

() Announcement was issued. As of February 7, 2022, Mr. Chen Huashen, the supervisor, had been in the middle of the reduction plan, and Mr. Chen Huashen did not reduce his shares in the company during the reduction plan period.

Opening medical treatment: electronic lower digestive tract endoscope obtained medical device registration certificate.

() On the evening of February 7th, it was announced that the company’s electronic lower digestive tract endoscope had been approved by Guangdong Drug Administration, and recently obtained the registration certificate of medical devices in People’s Republic of China (PRC).

Yongxing Materials received a financial subsidy of 43.2608 million yuan.

() Announcement. Recently, Huzhou Yongxing Materials Recycling Co., Ltd., a wholly-owned subsidiary of the company, received a financial subsidy of 43.2608 million yuan from Huzhou Finance Bureau in the form of cash subsidy. As of the date of this announcement, all the subsidy funds have been received.

Ocean Life spent 828,100 yuan to buy back 24,400 shares.

() Announcement was issued. As of January 31st, 2021, the company has repurchased 24,400 shares of the company by centralized bidding through the special securities account, accounting for 0.0004% of the company’s total share capital. The highest transaction price is 33.98 yuan/share, the lowest transaction price is 33.88 yuan/share, and the accumulated transaction amount is 828,100 yuan (excluding transaction costs). This repurchase is in line with the requirements of relevant laws and regulations.

Nanjing Julong: Ten shareholders including Wang Gang intend to reduce their holdings by no more than 795,300 shares.

() Announcement: Recently, the company received the Notice of Share Reduction Plan issued by 10 shareholders, namely Wang Gang, Zhang Jincheng (senior manager of the company), Zhao Yong, Liu Zhaoning, yan wang, Liu Ming, Zhu Shujun, Wu Zhong, Liu Zhiwei and Zhang Yechun, respectively. The above shareholders plan to reduce their shares in the company by centralized bidding, with a total of no more than 795,300 shares, accounting for 0.5% of the company’s total share capital.

Zuoli Pharmaceutical Co., Ltd.: The workshop of Chinese herbal pieces passed the GMP compliance inspection.

() Announcement was issued. Recently, the company inquired about the "GMP compliance inspection results of Zhejiang Drug Administration No.0013" on the website of Zhejiang Drug Administration, and learned that the inspection results of the company’s Chinese herbal pieces workshop met the requirements.

According to the announcement, the company’s Chinese herbal pieces workshop passed the GMP compliance inspection, indicating that the company’s production line meets GMP requirements, which is conducive to the company’s related products to meet market demand.

Shenghui Technology has been re-recognized by high-tech enterprises.

() Announcement: Recently, the company received the Certificate of High-tech Enterprise jointly issued by Shandong Provincial Department of Science and Technology, Shandong Provincial Department of Finance and Shandong Provincial Taxation Bureau of State Taxation Administration of The People’s Republic of China, with the certificate number GR202137006918, the issuing date is December 10, 2021, and the validity period is three years.

Huisen Investment, a shareholder of Gaomeng New Materials, has not reduced its shareholding for more than half of the time.

() Announcement. Today, the company received a Letter of Notice on the Progress of the Share Reduction Plan jointly issued by three concerted actions of shareholders Huisen Investment, Tang Xiaolin and Hu Yuyou. As of the disclosure date of this announcement, the above-mentioned reduction plan has been over half, and no reduction has been made during the reduction plan period.

Aoyang Group, the controlling shareholder of Aoyang Health, pledged 22.3 million shares each.

() Announcement, the company recently received a notice from the controlling shareholder Aoyang Group Co., Ltd. (hereinafter referred to as "Aoyang Group"), and learned that some shares held by Aoyang Group were released from pledge and some shares were pledged at the same time.

This time, 22.3 million shares were released from pledge, accounting for 9.48% of its shares and 2.87% of the company’s total share capital.

This time, 22.3 million shares were pledged, accounting for 9.48% of its shares and 2.87% of the company’s total share capital.

Qianhai Life Insurance, the major shareholder of OCT A, has reduced its holdings of 47.7439 million shares for more than half of the reduction period.

OCT A announced that by February 5, 2022, Qianhai Life Insurance Co., Ltd. ("Qianhai Life Insurance"), a shareholder holding more than 5% of the company’s shares, and Shenzhen Jushenghua Co., Ltd. ("Jushenghua"), a concerted action, had reduced their holdings by more than half, and Qianhai Life Insurance had reduced its holdings by 47,743,900 shares, accounting for 0.58% of the total share capital.

Baode Science and Technology Group, the controlling shareholder of Zhongqingbao, pledged 1.5 million shares of the company.

() Announcement: Recently, the company received a letter from Baode Science and Technology Group Co., Ltd., the controlling shareholder of the company, and learned that some of its shares were pledged. The number of shares pledged this time was 1.5 million, accounting for 0.57% of the company’s total share capital.

Blue Ocean Huateng repurchased 1,316,100 shares at a cost of 15,008,200 yuan.

() Announcement was issued. As of January 31, 2022, the company repurchased 1,316,100 shares of the company through the special securities account for stock repurchase, with a total amount of 15,008,200 yuan. The cumulative number of shares repurchased accounted for 0.63% of the company’s total share capital, with the highest transaction price of 15.72 yuan/share and the lowest transaction price of 10.60 yuan/share.

Sannuo Bio bought back 4,561,100 shares at a cost of 122 million yuan.

() Announcement was issued. As of January 31, 2022, the company repurchased 4,561,100 shares of the company through the special securities account for share repurchase, accounting for 0.81% of the company’s total share capital. The highest transaction price was 29.637 yuan/share, the lowest transaction price was 23.419 yuan/share, and the total transaction amount was 122 million yuan (excluding transaction fees).

Sega Technology spent 12.159 million yuan to buy back 1.5 million shares.

() Announcement was issued. As of January 31, 2022, the company had repurchased 1.5 million shares, accounting for 0.5942% of the company’s total share capital. The highest transaction price of repurchased shares was 8.46 yuan/share, and the lowest transaction price was 7.66 yuan/share, with a total turnover of 12.159 million yuan (excluding related transaction costs).

Tailong shares have not been repurchased as of January 31st.

() Announcement was issued. As of January 31, 2022, the company’s special securities repurchase account has not yet implemented the operations related to this share repurchase.

Gaolan shares have spent 30.054 million yuan to buy back 3.3716 million shares.

() Announcement was issued. As of January 31st, 2022, the company repurchased 3,371,600 shares of the company by centralized bidding, accounting for 1.20% of the company’s total share capital. The highest transaction price was 13.93 yuan/share, the lowest transaction price was 7.68 yuan/share, and the total amount paid was 30.054 million yuan.

Sun Jianxi, the actual controller of Dagang Holdings, released the pledge of 18 million shares.

() Announcement was issued. On February 6, 2022, the company received a notice from Ms. Chien Sun Xi, the controlling shareholder and actual controller, and learned that some of its shares pledged to Guotai Junan Securities Co., Ltd. had been deregistered in China Securities Depository and Clearing Co., Ltd. on January 28, 2022, and 18 million shares were released this time, accounting for 21.26% of its shares and 5.67% of its total share capital.

Wang Yong, a shareholder of Kaifa Electric, has reduced his holdings of 650,000 shares for more than half of the time.

() Announcement. Recently, the company received the Notice Letter on Share Reduction issued by shareholder Wang Yong. As of the disclosure date of the announcement, shareholder Wang Yong has reduced the company’s share holdings by 650,000 shares, and the planned reduction time has been more than half.

Oriental Yuhong has spent 102 million yuan to buy back 2,530,600 shares.

() Announcement was issued. As of January 31, 2022, the company has repurchased 2,530,600 shares by centralized bidding through the special securities repurchase account, accounting for 0.10% of the company’s total share capital. The highest transaction price was 4.890 yuan/share, the lowest transaction price was 3.724 yuan/share, and the total transaction amount was 102 million yuan.

Junyuan Pharmaceutical, a subsidiary of Saisheng Pharmaceutical, passed the on-site compliance inspection of drug GMP.

() Announcement: Recently, the company received the notice of the GMP compliance inspection result (No.:Liao 22010002) of Shenyang Junyuan Pharmaceutical Co., Ltd. (hereinafter referred to as "Junyuan Pharmaceutical"), and now the relevant information is announced as follows: Junyuan Pharmaceutical passed the GMP on-site compliance inspection, indicating that the three dosage forms production lines of Junyuan Pharmaceutical meet GMP requirements. It is conducive to improving the company’s product structure, improving production capacity and expanding market scale, and has a positive role in promoting the company’s stable development in the future.

Mona Lisa has not yet implemented share repurchase.

() Announcement, as of January 31, 2022, the company has not implemented share repurchase.

Tan Fenfang, supervisor of Lier Chemical, reduced his holdings by 30,100 shares by more than half.

() Announcement was issued. On February 7, 2022, the company received the Notice Letter on the Progress of Share Reduction Plan from Ms. Tan Fenfang, the supervisor. As of January 28, 2022, more than half of the shares were reduced as disclosed in the above pre-disclosure announcement, and the company reduced its shares by 30,100 shares, accounting for 0.0057% of the company’s total share capital.

Open medical treatment: "electronic lower digestive tract endoscope" obtained medical device registration certificate.

A medical announcement was issued. One of the company’s medical device products has been approved by Guangdong Drug Administration, and the People’s Republic of China (PRC) Medical Device Registration Certificate has been obtained recently. The approval date of the certificate is January 27th, 2022, the effective date is January 27th, 2022, and the validity period is January 26th, 2027. The registration certificate number is Yue Xie Zhu Zhun 2022060099, and the product name is Dianxia.

OCT A: Qianhai Life Insurance reduced its shareholding by 0.58%.

OCT A announced on the evening of February 7 that the shareholder Qianhai Life Insurance and the concerted action person Qi Shenghua had reduced their holdings by more than half, and Qianhai Life Insurance reduced its holdings by 47.74 million shares, accounting for 0.58% of the total share capital.

Li Rong, deputy general manager of World Bank, received a warning letter from the Securities Regulatory Bureau and a supervision letter from the Exchange.

On February 6th, Shenzhen () Group Co., Ltd. (hereinafter referred to as "World Bank") announced that the senior management of the company had received the warning letter from Shenzhen Securities Regulatory Bureau and the supervision letter from Shenzhen Stock Exchange.

According to the announcement, World Bank recently received the Decision of Shenzhen Securities Regulatory Bureau on Taking Measures to Issue a Warning Letter to Li Rong issued by Shenzhen Supervision Bureau of China Securities Regulatory Commission (hereinafter referred to as the Warning Letter) and the Supervision Letter on Li Rong, Deputy General Manager of Shenzhen World Bank Group Co., Ltd. issued by Shenzhen Stock Exchange (hereinafter referred to as the Supervision Letter).

According to the Warning Letter, during his tenure, Yong-Jae Lee, deputy general manager of World Bank, reduced his holdings of about 110,000 shares of the company through centralized bidding on the exchange on September 1, 2021, with a reduction ratio of 0.0054%. As a senior manager of the company, Li Rong did not report to the stock exchange and disclose the reduction plan in advance 15 trading days before the reduction of the above shares, which violated the provisions of Article 8, paragraph 1, of Several Provisions on the Reduction of Shares by Shareholders and Directors of Listed Companies.

According to the announcement, after receiving the Warning Letter and Supervision Letter, Li Rong attached great importance to the problems pointed out in it, and said that he would fully learn from the lessons, earnestly strengthen the study of relevant laws, regulations and normative documents such as the Securities Law, the Company Law, the Stock Listing Rules, further improve the awareness of standardized operation, strictly regulate the stock trading behavior, and prevent such incidents from happening again.

Lear Chemical does not redeem "Lear Convertible Bonds" in advance.

Lear Chemical announced that the company held the 19th meeting of the 5th Board of Directors on February 7th, 2022, and reviewed the Proposal on Whether to Exercise the Redemption Right of Lear Convertible Bonds. After full discussion and voting by all directors, considering that the conversion time of Lear Convertible Bonds is relatively short, and considering the current market situation, the directors attending the meeting unanimously voted not to exercise the redemption right, so the board of directors decided not to exercise the early redemption right of Lear Convertible Bonds this time.

At the same time, according to the Measures for the Administration of Convertible Corporate Bonds of CSRC and the relevant requirements of Shenzhen Stock Exchange, during the period from February 8, 2022 to May 7, 2022, if "Lier Convertible Bonds" triggers the redemption clause again, they will not exercise this right and will not redeem "Lier Convertible Bonds" in advance.

Deyi Wenchuang has not yet implemented this share repurchase plan.

() Announcement, as of the end of January 2022, the company has not implemented this share repurchase plan.

Kangli Elevator has spent 30,048,600 yuan to repurchase 3,888,500 shares.

() Announcement was issued. As of January 31, 2022, in this repurchase scheme, the company repurchased 3,888,500 shares of the company by centralized auction trading through the repurchase special securities account, accounting for 0.49% of the company’s total share capital before the implementation of the share repurchase scheme. The highest transaction price was 8.10 yuan/share, the lowest transaction price was 7.38 yuan/share, and the total transaction amount was 30,048,600 yuan.

Shenkai shares spent 62.5276 million yuan to buy back 10 million shares.

() Announcement was issued. As of January 31, 2022, the company repurchased 10 million shares of the company through the special securities account for share repurchase, accounting for 2.75% of the company’s total share capital. The highest transaction price was 6.78 yuan/share, the lowest transaction price was 5.77 yuan/share, and the total transaction amount was 62.5276 million yuan (including transaction costs).

Ningbo Huaxiang repurchased 496,600 shares at a cost of 9,997,100 yuan.

() Announcement was issued. As of January 31, 2022, the company repurchased 496,600 shares of the company by centralized bidding through the special securities account for repurchasing shares, accounting for 0.061% of the company’s current total share capital. The highest transaction price was 20.22 yuan/share, the lowest transaction price was 19.99 yuan/share, and the total transaction amount was 9,997,100 yuan (excluding transaction costs).

Huaxia Airlines has repurchased 4.63 million shares at a cost of 50.0458 million yuan.

() Announcement was issued. As of January 31st, the company repurchased 4.63 million shares by centralized bidding through the special securities account, accounting for 0.4568% of the company’s total share capital. The highest transaction price of repurchased shares was 12.21 yuan/share, and the lowest transaction price was 9.99 yuan/share, and the total paid amount was 50.0458 million yuan.

The listing review of the initial public offering of Livzon Group’s shareholding companies was suspended.

() Announcement, the company recently learned that Tianjin () Group Co., Ltd. (hereinafter referred to as "Tianjin Tongren"), the company’s shareholding company, recently received the Notice of Tianjin Tongren _IPO_ Access Project Suspension issued by Shenzhen Stock Exchange (hereinafter referred to as "Shenzhen Stock Exchange"). XinYong Zhonghe Certified Public Accountants (special general partnership), an accountant hired by Tianjin Tongren for initial public offering and listing on the Growth Enterprise Market, was put on file for investigation by the China Securities Regulatory Commission. According to the relevant provisions of Article 64 of the Rules for the Examination of Stock Issuance and Listing on the Growth Enterprise Market of Shenzhen Stock Exchange, the Shenzhen Stock Exchange suspended the examination of Tianjin Tongren’s IPO and listing on January 26, 2022.

Asia Pacific was selected as the supplier of ABS actuators for SUV models of a foreign customer.

() Announced, the company recently received a notice from a domestic trading company that the company has been selected as the supplier of ABS actuators (including acceleration sensors) for an SUV model of a foreign customer. After receiving the notice, the company will immediately carry out the follow-up work and actively promote it according to the requirements of customers.

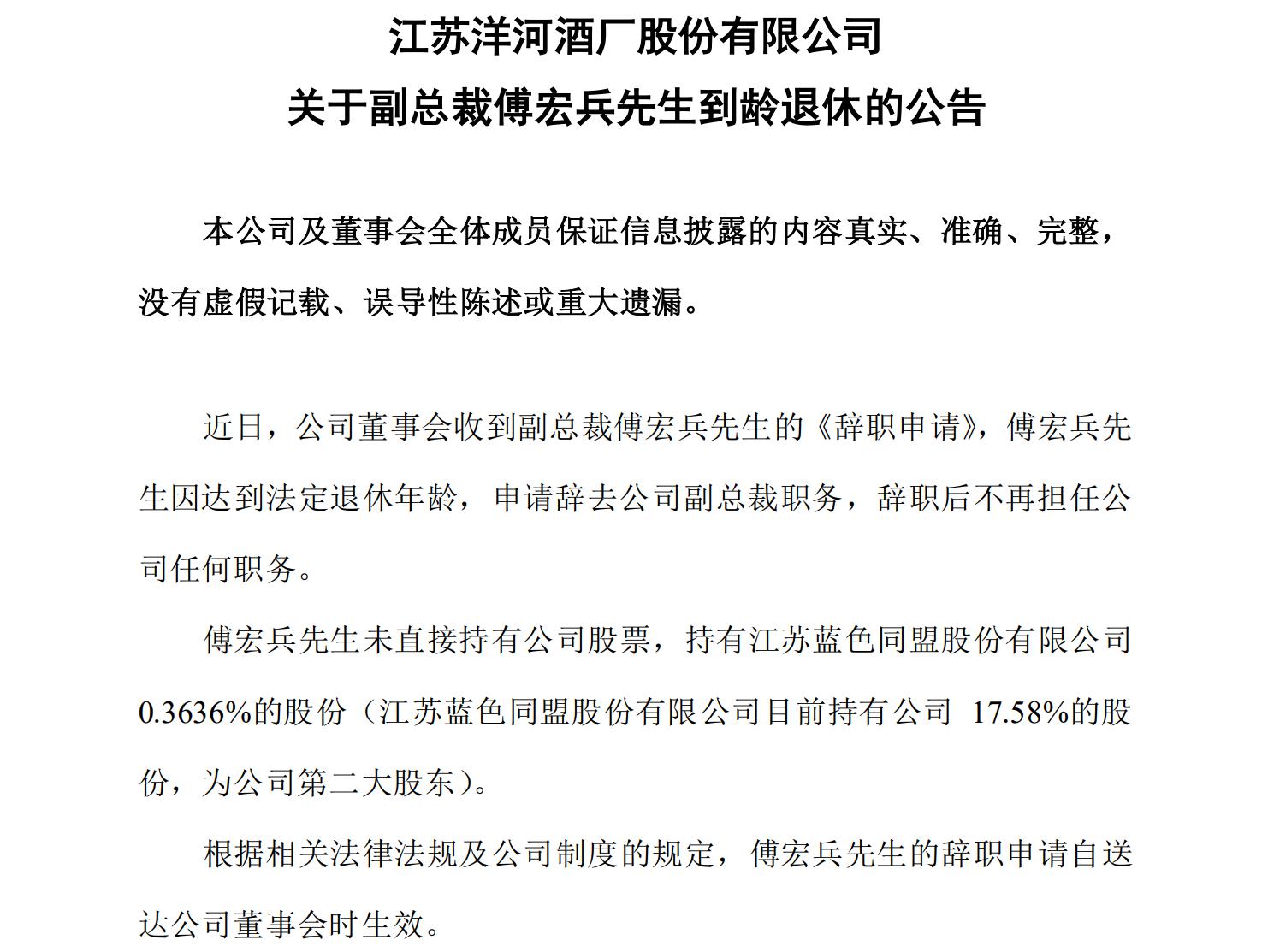

Fu Hongbing, Vice President of Yanghe, retired.

() Announcement. Recently, the board of directors of the company received the "Resignation Application" from Mr. Fu Hongbing, the vice president of the company. Mr. Fu Hongbing applied to resign as the vice president of the company because he reached the legal retirement age, and he no longer held any position in the company after his resignation.

Asia-Pacific shares: qualified for supporting projects.

Asia Pacific announced on the evening of February 7 that the company had recently received a notice from a domestic trading company that the company had been selected as the supplier of ABS actuators (including acceleration sensors) for an SUV model of a foreign customer.

Bian Ruiqun, director of Yashi Optoelectronics, intends to reduce his holdings by no more than 1.881 million shares.

() Announced that Ms. Bian Ruiqun, the company’s shareholder, director and senior manager, plans to reduce her holdings of the company’s shares by centralized bidding and block trading within 180 days after 15 trading days from the date of this announcement, accounting for no more than 1.881 million shares, accounting for no more than 1.1446% of the company’s total share capital.

Ma Tianyuan, general manager of Honghui New Materials, intends to reduce his holdings by no more than 28,100 shares.

() Announced, Mr. Ma Tianyuan, the general manager of the company, plans to reduce his holding of no more than 28,100 shares by centralized bidding within six months after 15 trading days from the disclosure date of this announcement, accounting for 0.03% of the company’s total share capital.

Jinfei Kaida did not repurchase shares in January.

() Announced that during the period from January 1, 2022 to January 31, 2022, the company did not repurchase shares.

Guizhou Tire: 7.352 million restricted shares will be listed and circulated on February 11th.

() Announced a suggestive announcement about the first release of restricted shares in the restricted stock incentive plan in 2019. This time, there were 443 incentive targets who met the conditions for the release of restricted shares, and the number of shares that could be released was 7.352 million, accounting for 0.77% of the company’s current total share capital. The listing and circulation date was February 11, 2022.

Keming Food repurchased 1,231,500 shares at a cost of 13,260,300 yuan.

() Announcement was issued. As of January 31st, 2022, the company repurchased 1,231,500 shares by centralized bidding through the special securities account for stock repurchase, accounting for 0.37% of the company’s total share capital at present. The average transaction price was 10.77 yuan/share, the lowest price was 10.15 yuan/share, the highest price was 11.18 yuan/share, and the total payment was 13,260,300 yuan.

Yanjinpuzi: The controlling shareholder once again made an additional commitment to extend the lock-up period for 2 years.

On the afternoon of February 7th, () announced the additional commitment of the controlling shareholder of the company. The announcement showed that Yanjinpuzi Food Co., Ltd. recently received the Letter of Commitment on Additional Share Lock-up Period issued by Hunan Yanjinpuzi Holding Co., Ltd. (holding 48,381,503 shares of the company, accounting for 37.40% of the company’s total share capital). Based on the recognition of the company’s long-term value and confidence in the company’s future development, Hunan Yanjin Puzi Holding Co., Ltd. voluntarily extended the lock-up period for 2 years to February 11, 2024 for the shares of the company that have been released from the lock-up period for 2 years.

(Editor: Xu Yuting)

Gao Jian, director of Hanjia Design, intends to reduce his holdings by no more than 1 million shares.

() Announcement, Mr. Gao Rebuilding, the director of the company, plans to reduce the company’s shares by centralized bidding within 6 months after 15 trading days from the disclosure date of this announcement, with a total reduction of no more than 1 million shares (accounting for 0.44% of the company’s total share capital).

Wanshun New Materials bought back 21,204,500 shares at a cost of 102.6 million yuan.

() Announcement was issued. As of January 28th, 2022, the company has repurchased 21,204,500 shares of the company by centralized auction trading through the special stock repurchase account, accounting for 3.10% of the company’s total share capital on January 28th, 2022 (without deducting the shares in the special repurchase account). The highest repurchase price is 5.00 yuan/share, the lowest repurchase price is 4.53 yuan/share, and the total turnover is 1.

Hexing Packaging has spent 71.09 million yuan to buy back 20.1 million shares.

() Announcement was issued. As of January 31, 2022, the second phase of the company’s repurchase plan repurchased 20.1 million shares of the company by centralized auction trading through repurchase special securities accounts, accounting for 1.62% of the company’s current total share capital, of which the highest transaction price was 3.75 yuan/share, the lowest transaction price was 3.35 yuan/share, and the total transaction amount was 71.09 million yuan.

Yashi Optoelectronics: The controlling shareholder promises not to reduce the company’s shares during a specific period.

Yashi Optoelectronics announced on the evening of February 7 that Yashi Optoelectronics (Hong Kong) Co., Ltd., the controlling shareholder, currently holds 60,223,500 shares of the company, accounting for 366,457% of the company’s total share capital, and the above shares are planned to be lifted on March 27. Yashi Optoelectronics (Hong Kong) Co., Ltd. promises not to reduce its shares in listed companies in any way within 12 months from the date when the restrictions on the sale of its shares are lifted.

Azure Lithium Core Company received a government subsidy of 105 million yuan.

() Announced that Tianpeng Lithium Energy Technology (Huai ‘an) Co., Ltd. (hereinafter referred to as "Tianpeng Lithium Energy"), a wholly-owned subsidiary of the company, recently received 91,361,800 yuan of industrial development support funds allocated by the financial payment center of Qingjiangpu District of Huai ‘an City, which is a government subsidy related to assets. Tianpeng Lithium Energy has actually received the funds and will be confirmed as deferred revenue.

At the same time, Huai ‘an Aoyang Shunchang Optoelectronic Technology Co., Ltd. (hereinafter referred to as "Huai ‘an Optoelectronic"), a holding subsidiary, recently received a total of 13,767,600 yuan from the financial payment center of Qingjiangpu District of Huai ‘an City, which is a government subsidy related to income. Huai ‘an Optoelectronic has actually received the money and will confirm it as the current income.

In 2022, the continuous winning bid for construction and repair exceeded 346 million.

On the afternoon of February 7th, the first day of returning to work during the Spring Festival holiday, Construction Engineering Restoration (SZ300958) issued a bid-winning announcement. Recently, the company received the Notice of Winning Bid from Tianjin Beichen District Land Consolidation Center and Tianjin Pan Asia Engineering Consulting Co., Ltd., informing the consortium formed by the company and Zhongshui North Survey, Design and Research Co., Ltd. to win the bid for the dolphin rubber plot restoration and treatment project, with a contract amount of over 316 million yuan.

Earlier, the company also successfully won the bid for the plot restoration project of Yancheng Lianfu Petrochemical Co., Ltd. West Plant, with the winning bid amount of 30.7265 million. At the beginning of the new year in 2022, it won an important bid continuously, which showed the company’s strong marketing momentum and greatly boosted the market influence. After the formal contract is signed and implemented smoothly, it is expected to have a positive impact on the company’s performance.

It is understood that Dolphin Rubber Plot is located in Beichen District, Tianjin, and it is another large-scale site restoration project undertaken and implemented in Tianjin after Tianjin pesticide plant Plot Restoration Project, Tianjin Heiniucheng Road Plot Restoration Project and Tianjin Reagent No.1 Factory Plot Restoration Project. There are petroleum hydrocarbons, polycyclic aromatic hydrocarbons and monocyclic aromatic hydrocarbons in the soil and groundwater of this plot, which is a typical industrial pollution site remediation project. Based on the plane and three-dimensional analysis of the survey data, combined with the land use planning, the project plans to adopt the combined restoration mode of "multi-process combination and deep management and control" to restore by layers and pollution types. At the same time, the project will also build the first large-scale NAPLs (non-aqueous liquid) recovery project in China, which will comprehensively demonstrate the technical and engineering capabilities of engineering restoration and consortium in multi-technology collaboration, fine modeling and efficient NAPLs recovery of contaminated sites, and provide comprehensive solutions for the remediation and treatment of similar contaminated sites in China.

The land parcel restoration project of Yancheng Lianfu Petrochemical Co., Ltd. is located in the core area of Yancheng North Development. The main pollutants in the land parcel soil are antimony, arsenic, thallium, vanadium and severe alkalization, and the pollutants in the groundwater are volatile phenol, xylene and petroleum hydrocarbons C6-C9. The restoration of construction works will implement "soil and water co-governance" for this plot. According to the future land use plan, after the land restoration is completed, it will meet the standards for residential land, commercial land and park green space specified in the Soil Environmental Quality Construction Land Soil Pollution Risk Control Standard (Trial) (GB36600-2018).

The two winning bids in the new year of 2022 show the excellent marketing ability and technical engineering strength of Construction Engineering Restoration in the field of site restoration, which is an important achievement of the company’s continuous deepening of its main business and its efforts to build a leading integrated environmental restoration service provider. In the future, the company will persist in creating value by service, lead the industry by innovation, help more cities and regions to transform and upgrade, and achieve green and sustainable development.

Central asia shares bought back 621,300 shares at a cost of 7,990,900 yuan.

() Announcement was issued. As of January 31, 2022, the company repurchased 621,300 shares of the company through the stock repurchase special securities account, accounting for 0.23% of the company’s total share capital. The highest transaction price was 14.73 yuan/share, the lowest transaction price was 12.32 yuan/share, and the total transaction amount was 7,990,900 yuan (excluding transaction costs).

There is no violation of fair disclosure of information in the stock price change of Hengli Industry.

() Announced that the deviation of the closing price of the company’s shares for three consecutive trading days (January 27, January 28 and February 7, 2022) has reached more than 20%, which is an abnormal fluctuation of stock trading according to the relevant provisions of the Listing Rules of Shenzhen Stock Exchange.

After self-examination, the company did not violate the fair disclosure of information.

* Liu Wei, shareholder of ST Schwab, reduced his holdings of 1.02 million shares by more than half.

() Announcement was issued. Previously, due to a loan contract dispute between Mr. Liu Wei and Mr. Lu Fanhua, the court decided to dispose of some company shares held by Mr. Liu Wei by judicial means, and Huatai Securities Co., Ltd. (hereinafter referred to as "Huatai Securities") assisted in the implementation. Up to now, Mr. Liu Wei has reduced his shareholding by more than half, and he reduced his shareholding by 1.02 million shares, accounting for 0.11% of the company’s total share capital.

The new open source repurchased 4,497,700 shares at a cost of 85,944,600.

() Announced that by January 31st, 2021, the company had bought back 4,497,700 shares through centralized bidding, accounting for 1.3089% of the company’s total share capital. The highest transaction price of the repurchased shares was 22.98 yuan/share, and the lowest transaction price was 18.00 yuan/share, with a total transaction amount of 85,944,600 yuan (excluding transaction costs).

Jilin Aodong Holding Company has obtained the listing record certificate of traditional Chinese medicine formula granules.

() Announced, recently, Yanbian Pharmaceutical, a holding subsidiary of the company, received the Certificate of Listing and Filing of Traditional Chinese Medicine Formula Granules from eight national standards. As the core enterprise of the company, Yanbian Pharmaceutical Co., Ltd. has certain advantages in the field of traditional Chinese medicine. As of the date of publication of the announcement, it has obtained 99 certificates for listing and filing of Chinese medicine formula granules, which is of great significance for the company to expand its business of Chinese medicine formula granules, creating favorable conditions for the company’s sustainable development and further enhancing its core competitiveness.

Fenglong shares were re-recognized by high-tech enterprises.

() Announcement, the company recently received the Certificate of High-tech Enterprise jointly issued by Zhejiang Science and Technology Department, Zhejiang Finance Department and Zhejiang Taxation Bureau of State Taxation Administration of The People’s Republic of China (certificate number: GR202133009277), which was issued on December 16, 2021 and was valid for three years. This time, the company’s original high-tech enterprise certificate was re-recognized upon expiration.

Yanbian Pharmaceutical Co., Ltd., a subsidiary of Aodong, Jilin Province, obtained the approval notice for the supplementary application of Shengmaiyin (Dangshen prescription)

Jilin Aodong issued an announcement. Recently, Yanbian Pharmaceutical Co., Ltd., a holding subsidiary of the company, received the Notice of Approval for Drug Supplement Application for Shengmai Drink (Dangshen Fang) issued by National Medical Products Administration. After examination, it was approved that the holder of the marketing license for this product was changed from Luoyang Ningzhu Pharmaceutical Co., Ltd. (address: industrial cluster area of Luoning County, Henan Province) to Jilin Aodong Yanbian Pharmaceutical Co., Ltd. (address: No.2158, Aodong Street, Dunhua City, Jilin Province) The transferred drugs can be marketed if they meet the requirements of product release after passing the conformity inspection in good manufacturing practice. The production site, prescription, production process and quality standard of the transferred drug are consistent with the original drug and will not be changed.

Yanbian Pharmaceutical Co., Ltd., a holding subsidiary of the company, obtained the Notice of Approval for Drug Supplement Application of Shengmai Drink (Dangshen Prescription), which increased the variety of products of the company and created favorable conditions for the further development of Yanbian Pharmaceutical Co., Ltd.

Chuanhua Zhilian bought back 23,929,900 shares at a cost of 200 million yuan.

() Announcement was issued. As of January 31, 2022, the company had repurchased 23,929,900 shares, accounting for 0.78% of the company’s total share capital. The highest transaction price was 9.224 yuan/share, the lowest transaction price was 7.940 yuan/share, and the total transaction amount was 200 million yuan (excluding transaction costs).

Baibang Technology repurchased 2.395 million shares at a cost of 29.8014 million yuan.

() Announcement was issued. As of January 31st, 2022, the company repurchased 2.395 million shares of the company by centralized bidding through the special securities account for share repurchase, accounting for 1.84% of the company’s current total share capital. The highest transaction price was 13.48 yuan/share, the lowest transaction price was 11.16 yuan/share, and the total transaction amount was 29.8014 million yuan (excluding transaction costs).

Weitang Industry obtained patent authorization.

() Announced that the company recently received a notice of granting utility model patents from China National Intellectual Property Administration, and seven utility model patents applied by the company to China National Intellectual Property Administration have been approved.

Huasheng Baili, the major shareholder of Tongda Co., Ltd., has not reduced its holdings by more than half through block trading.

() Announcement: As of February 4, 2022, Huasheng Baili Investment Development (Beijing) Co., Ltd. ("Huasheng Baili"), a shareholder holding 10.95% of the company’s shares, has spent more than half of its time in reducing its shareholding by block trading, and it has not reduced its shareholding.

Soil remediation market "gets off to a good start", construction and restoration accelerate "value transformation"

On February 7th, the announcement of construction project restoration said that the company received the Notice of Winning Bid from Tianjin Beichen District Land Consolidation Center and Tianjin Pan-Asia Engineering Consulting Co., Ltd., informing the consortium formed by the company and Zhongshui North Survey, Design and Research Co., Ltd. to win the bid for the dolphin rubber plot restoration and treatment project, with a bid amount of about 317 million yuan and a construction period of 18 months from the date of signing the contract.

It is reported that since 2022, construction engineering restoration has successively won the bid for Tianjin Dolphin Rubber Plot Restoration Project and Yancheng Lianfu Petrochemical Co., Ltd. West Plant Plot Restoration Project, with a total contract amount of about 346 million yuan, laying a good foundation for sprinting the business target in 2022.

It is understood that the actual controller of construction repair is the Beijing State-owned Assets Supervision and Administration Commission, which landed on the Growth Enterprise Market in March 2021. It is the first concept stock mainly engaged in environmental repair business in the A-share market. As one of the earliest companies specializing in environmental restoration services in China, the construction engineering restoration after listing is accelerating the construction of comprehensive environmental restoration service layout.

A few days ago, the 2021 Science and Technology Promotion Award of China Academy of Sciences was announced, and the scientific research team of "Key Technologies and Applications of Industrial Contaminated Site Restoration" participated in the construction project restoration successfully won the award. This is after winning the 2021 environmental technology progress award, the scientific and technological innovation strength of construction repair has once again been recognized by the authority. Supported by the scientific and technological service capabilities of leading industries, the company has a strong momentum to accelerate the value transformation of the environmental restoration industry chain.

Gao Yanli, vice president of China Environmental Protection Industry Association and general manager of construction engineering restoration, said: "With the diversification of environmental restoration and governance needs, the industry’s head enterprises will turn to the regional environmental comprehensive management service model through the combination of capital, market and specialty, especially to improve their operational capabilities, which will help fully release industrial value."

In 2021, the first batch of six "Environmental Hospital" service model pilot projects in Shandong Province were officially approved, and two projects, "Qingdao Environmental Hospital" and "Qilu Cloud Environmental Hospital", which were jointly declared for construction and restoration, were successfully selected, deepening model innovation in the field of remediation of contaminated sites with first-Mover advantages, and providing environmental policy consultation, diagnosis of environmental problems, system solutions, investment and financing of engineering construction, engineering design and construction, commissioning and operation for the government, enterprises and the public. At the same time, the company established an emergency disposal center for contaminated soil and groundwater in Yanziji New Town, Nanjing, explored the path of productization of contaminated soil, systematically solved the problem of regional pollution prevention and control, and opened up the market space for environmental restoration and operation.

Focusing on the "14th Five-Year Plan" of the country and the goal of carbon neutrality in peak carbon dioxide emissions, construction and restoration have frequently fallen into the business direction of ecological restoration. At the Global Coastal Forum, the company reached a strategic cooperation with Jiangsu Huanghai Wetland Research Institute to jointly build an experimental base for wetland purification and restoration, carry out research and development of key technologies and tackle key scientific problems, and make classified policies around different characteristics and governance needs of river and lake wetlands, coastal wetlands and urban wetlands, so as to scientifically promote the landing of wetland restoration projects. In Kunming, Yunnan Province, the project of comprehensive management of abandoned open-pit mines in the Yangtze River Economic Belt in Yunnan Province was undertaken for construction engineering restoration. Based on the achievements of material research and development, phosphogypsum was explored for soil improvement and pit filling, and ecological restoration and solid waste disposal were combined to realize the transformation of ecological benefits and economic benefits, and a model of "solid waste utilization+mine restoration" was created.

Li Shupeng, Secretary-General of Soil and Groundwater Committee of China Environmental Protection Industry Association and Deputy General Manager of Construction and Rehabilitation, said that during the "Tenth Five-Year Plan" period, with the joint promotion of policy guidance, technological innovation and financial empowerment, the soil remediation industry will enter a new stage of orderly, centralized and standardized development, and the soil remediation industry is expected to usher in greater development space.

The research reports issued by many institutions confirmed this judgment. Huajin Securities once predicted that the total market space in the three major areas of industrial contaminated site remediation, soil remediation in mining areas and cultivated land remediation could reach several trillion yuan in the future.

Jiajia Food has spent 20.317 million yuan to buy back 3.2648 million shares.

() Announcement was issued. As of January 31, 2022, the company repurchased 3,264,800 shares by centralized bidding through the special securities account, accounting for 0.28% of the company’s total share capital. The highest transaction price was 6.29 yuan/share, the lowest price was 6.11 yuan/share, and the total transaction amount was 20.317 million yuan (including transaction costs).

Wansheng Intelligent won the bid for the bidding project of related metering products of China Southern Power Grid, involving 44,231,100 yuan.

() Announcement: On January 25th, 2022, China Southern Power Grid Co., Ltd. announced the results of the second batch of frame bidding projects of China Southern Power Grid Corporation’s metering products in 2021 on the unified service platform of China Southern Power Grid Supply Chain. The company is one of the successful bidders for the above projects. According to the pre-bid quantity and quotation, it is estimated that the total bid amount is about 44,231,100 yuan.

Recently, the company received the Notice of Winning Bid from China Southern Power Grid Materials Co., Ltd., the tendering agency of China Southern Power Grid Co., Ltd.

Aodong, Jilin Province: The subsidiary has obtained 8 certificates for listing and filing of traditional Chinese medicine formula granules.

Jilin Aodong announced on the evening of February 7 that Yanbian Pharmaceutical, a holding subsidiary of the company, recently received the "Certificate of Listing and Filing of Traditional Chinese Medicine Formula Granules" from eight national standards. Up to now, Yanbian Pharmaceutical Co., Ltd. has obtained a total of 99 Certificates for Listing and Filing of Traditional Chinese Medicine Formula Granules.

Moen Electric applied for a working capital loan of 115 million yuan from the bank.

() Announce, in order to promote the business development of the company, optimize the financial structure and meet the daily capital demand, the company plans to use the company’s workshops (Property Ownership CertificateNo.: Hu (2021) Zi Real Estate Ownership No.000443, with a construction area of 54454) located in the whole building of No.669 Cenglin Road, No.268 Feizhou Road and No.268 Tian Snowy Road.

Yiwei Lithium Energy has spent 100 million yuan to buy back 1,372,400 shares.

() Announcement was issued. As of January 31, 2022, the company has repurchased 1,372,400 shares by centralized bidding through the special securities account for share repurchase, with the highest transaction price of 75.20 yuan/share, the lowest transaction price of 71.00 yuan/share and the total transaction amount of 100 million yuan.

Xi’ an Tourism’s affiliated stores resumed operations in an orderly manner.

() Announced that at present, the epidemic prevention and control work in Xi ‘an has achieved remarkable results. In accordance with the spirit of the document of the provincial and municipal governments on promoting the resumption of production and work in an orderly manner, the company actively responded to the call and continued to focus on epidemic prevention and control and production and operation. The hotel business and commercial business of the company have resumed normal business one after another; The travel agency business will continue to strictly implement the requirements of the Xi ‘an Municipal Government on epidemic prevention and control, and make preparations for the gradual resumption of business.

Yiwei Lithium Energy plans to build Huizhou 100 billion-level new energy battery industry cluster.

Yiwei Lithium Energy announced that on January 29, 2022, the company signed the Strategic Cooperation Framework Agreement with Huizhou Municipal People’s Government. The two sides will deepen strategic cooperation, thoroughly implement the national strategic plan of "peak carbon dioxide emissions, Carbon Neutralization", build a new energy battery industry cluster with a level of 100 billion in Huizhou, and support the company’s further development and growth.

The Strategic Cooperation Framework Agreement signed this time is only an intentional document for both parties to carry out strategic cooperation, and the specific cooperation content will be stipulated in a separate contract, which is still uncertain.

Asia-Pacific shares have obtained supporting qualifications for the project.

Asia Pacific shares announced that the company recently received a notice from a domestic trading company that the company has been selected as the supplier of ABS actuators (including acceleration sensors) for SUV models of a foreign customer. After receiving the notice, the company will immediately carry out the follow-up work and actively promote it according to the requirements of customers.

The cumulative repurchase of 1,659,800 shares of national porcelain materials cost 67,207,800 yuan.

() Announcement was issued. As of January 31, 2022, the company repurchased 1,659,800 shares of the company through the special securities account for stock repurchase, accounting for 0.1654% of the company’s total share capital. The highest transaction price was 41.68 yuan/share, the lowest transaction price was 39.64 yuan/share, and the total transaction amount was 67,207,800 yuan (excluding transaction costs).

There are no major events that should be disclosed but not disclosed in the stock price change of Wan Liyang.

() It was announced that the closing price of the company’s stock trading on January 27, January 28 and February 7, 2022 had fallen by more than 20%, which was an abnormal fluctuation of stock trading according to the relevant regulations of Shenzhen Stock Exchange.

Upon inquiry to the management, controlling shareholder and actual controller of the company, there are no major matters about the company that should be disclosed but not disclosed, or major matters in the planning stage.

24.295 million restricted shares of Shang Rong Medical were listed and circulated on February 11th.

() Issue an announcement to lift the restricted shares from listing and circulation on February 11, 2022.

The number of restricted shares of RMB ordinary shares (A shares) released this time is 24.295 million shares, accounting for 2.8762% of the company’s total shares at present, which is the restricted circulation shares issued by the company’s non-public offering of shares in 2020.

Tapai Group spent 236 million yuan to buy back 21,849,100 shares.

() Announcement was issued. As of January 31, 2022, the company repurchased 21,849,100 shares through the special securities account for share repurchase by centralized bidding, accounting for 1.83% of the company’s total share capital. The highest transaction price was 11.39 yuan/share, the lowest transaction price was 9.88 yuan/share, and the total amount paid was 236 million yuan (including transaction fees).

Hengyi Petrochemical repurchased 23.8394 million shares at a cost of 250 million yuan.

() Announcement was issued. As of January 31st, 2022, the company repurchased 23,839,400 shares by centralized bidding through the special securities account, accounting for 0.65% of the company’s total share capital. The highest transaction price of the purchased shares was 10.69 yuan/share, and the lowest transaction price was 10.13 yuan/share, and the total repurchase amount paid was 250 million yuan (excluding commission, transfer fees and other transaction fees).

Sanlian Hongpu signed a daily operation contract of 70.276 million yuan.

() Announced that the company recently signed a high-quality differential nylon 6-FDY spinning project contract with Sanning Chemical, with a contract amount of 70.276 million yuan, accounting for 8.03% of the company’s audited operating income in 2020. The successful implementation of the contract will have a positive impact on the company’s performance in the next 1-2 years.

The strong cooperation between the two parties will help Sanning Chemical to further optimize the layout of caprolactam-integrated new material industrial chain cluster, enrich the product diversification structure, and have strong demonstration value for the high-quality green development of polyamide industry; At the same time, it will further consolidate the company’s competitive advantage in the field of nylon 6 spinning service and play a positive role for the company to gain greater market share in the future.

Xie Limin, vice chairman of Yantang Dairy, intends to reduce the holding of no more than 98,100 shares of the company.

() Announced that the company received the Letter of Notice on Share Reduction Plan issued by Mr. Xie Limin, the vice chairman of the company, on February 7, 2022. Mr. Xie Limin, the vice chairman who holds 392,400 shares of the company (accounting for 0.2494% of the company’s total share capital), plans to reduce the company’s shares by centralized bidding within 6 months after 15 trading days from the date of this announcement (accounting for 0.0623% of the company’s total share capital).

Jitai shares spent 12.3218 million yuan to buy back 1.6886 million shares.

() Announcement was issued. By January 31st, 2022, the company had bought back 1,688,600 shares of the company by centralized bidding, accounting for 0.453% of the company’s total share capital at present. The highest transaction price was 7.39 yuan/share, the lowest transaction price was 7.12 yuan/share, and the transaction amount was 12,321,800 yuan (excluding transaction costs).

Langxin Technology: The conditional redemption clause of "Langxin Convertible Bonds" may be triggered in the future.

() Announced that from January 18, 2022 to February 7, 2022, the closing price of the company’s shares has exceeded 130% of the current conversion price (15.39 yuan/share) for 10 trading days. Subsequent conditional redemption clauses of "Langxin Convertible Bonds" may be triggered.

Weikawei, the shareholder of Jingwei, Germany, has reduced its shareholding by 2% and intends to continue to reduce its shareholding in the company.

() Announced that as of February 2, 2022, the period of the German Weikawei reduction plan expired. During the implementation of the reduction plan, Germany Weikawei reduced its holdings of 29,999,999 shares through centralized bidding, accounting for 2% of the company’s total share capital.

In addition, Germany Weikawei plans to reduce its holdings by no more than 30 million shares within 180 days after 15 trading days from the disclosure date of the suggestive announcement, that is, no more than 2% of the company’s total share capital; The number of holdings reduced through block trading shall not exceed 60 million shares, that is, it shall not exceed 4% of the company’s total share capital.

Yanghe shares: Fu Hongbing retired at age and resigned as vice president.

On February 7, Jiangsu Yanghe Distillery Co., Ltd. (hereinafter referred to as "Yanghe") announced that recently, the board of directors of the company received the "Resignation Application" from Fu Hongbing, the vice president of the company. Fu Hongbing applied to resign from the position of vice president of the company because he reached the legal retirement age, and he no longer held any position in the company after resigning. According to the relevant laws and regulations and the company system, Fu Hongbing’s resignation application takes effect when it is delivered to the company’s board of directors.

According to the announcement, Fu Hongbing does not directly hold the company’s stock, but holds 0.3636% of the shares of Jiangsu Blue Alliance Co., Ltd. (Jiangsu Blue Alliance Co., Ltd. currently holds 17.58% of the shares of Yanghe, making it the second largest shareholder of the company).

As of the close of February 7, Yanghe’s share price was 162.9 yuan, up 4.19% on that day, with a total market value of 245.488 billion yuan.

Editor Zheng Mingzhu proofreads Li Ming.

Energy-saving man of iron signed the construction contract of comprehensive upgrading project around Dongguan Weiyuan Island Naval War Museum.

() Announcement, the company recently received the Construction Contract of Comprehensive Improvement Project around Weiyuan Island Naval Battle Museum in marina bay New District, Dongguan, Guangdong Province, which was signed with Dongguan marina bay New District Engineering Construction Center (the "Employer") and man of iron Ecological Construction Co., Ltd. (the "man of iron Construction"). The contract price of the project is 108 million yuan, accounting for 2.57% of the company’s audited operating income of 4.211 billion yuan in 2020. The planned project duration is 482 calendar days.

Tongyu Heavy Industry: Guangjin Meihao Tongyu Haisheng Private Equity Investment Fund’s increase plan has not yet been implemented.

() Announce that 25 relevant personnel (hereinafter referred to as participants), including some directors, senior managers and other core managers of the company, plan to increase their shares in the company from November 2, 2021 to May 2, 2022 through the contractual private equity fund-"Guangjin Meitong Haiyu Haisheng Private Equity Investment Fund" (hereinafter referred to as "the fund" or "the main body of increase"). There is no price range for this increase plan.

As of the disclosure date of this announcement, the period of the fund’s shareholding plan has been more than half, and its shareholding plan has not yet been implemented.

Huanrui Century: The revenue from Bears Coming Back to Earth is about 7.5 million yuan.

() It was announced on the evening of February 7th. According to incomplete statistics, as of 24: 00 on February 6th, Huanrui (Dongyang) Investment Co., Ltd., a wholly-owned subsidiary of the company, had participated in the joint production of the film "Bears Come Back to Earth", and its box office revenue (including service fee) had exceeded 562 million yuan. As of February 6th, the company’s operating income from the film (currently box office income) was about 7.5 million yuan.

Energy-saving man of iron pre-won the bid for the renovation and upgrading of rainwater and sewage pipe network in Jinggangshan Scenic Area and the treatment project of Yicui Lake water system.

Man of iron announced that the company and its wholly-owned subsidiary, man of iron Ecological Construction Co., Ltd. ("man of iron Construction" and "Consortium Leader") formed a bidding consortium, and recently participated in the public bidding of "EPC Project for Renovation and Upgrading of Rainwater and Sewage Pipe Network in Ciping Scenic Area, Jinggangshan, Jiangxi Province". The tenderer of this project is Jinggangshan Scenic Area Administration. According to the information released by Jiangxi Public Resources Trading Network on January 28th, 2022, the bidding consortium composed of the company and man of iron Construction has been listed as the first successful candidate recommended by the bid evaluation committee.

The announcement shows that the total investment of the project is 165.71 million yuan, and the planned construction period is 150 calendar days. The construction contents are: (1) the renovation and upgrading project of rainwater and sewage pipe network in Ciping Scenic Area of Jinggangshan; (2) The first phase of the water system improvement project of Yicuihu Lake in Ciping Scenic Area of Jinggangshan, including the landscape improvement of Yicuihu Park in Ciping Town.

Zhongxin Tourism has reduced its holdings of 654,100 repurchased shares.

() Announcement was issued. As of January 31st, the company has reduced the number of repurchased shares by centralized bidding to 654,100 shares, accounting for 0.0722% of the company’s total share capital. The total amount of funds obtained from the reduction is 4.14 million yuan (excluding transaction costs). The highest price of the reduction is 6.34 yuan/share, the lowest price is 6.30 yuan/share, and the average price of the reduction is 6.33 yuan/share.

BOE A: It has spent 2.577 billion yuan to buy back 491 million shares of the company.

BOE A announced on the evening of February 7 that as of January 31, the company had repurchased 491 million A shares, accounting for 1.3090% of the company’s A shares and 1.2771% of the company’s total share capital. The highest transaction price of this repurchase was 5.96 yuan/share, the lowest transaction price was 4.83 yuan/share, and the total payment was 2.577 billion yuan.

Sanlian Hongpu: signed a spinning project contract of 70.276 million yuan.

Sanlian Hongpu announced on the evening of February 7 that the company recently signed a contract with Hubei Sanning Chemical Co., Ltd. for a high-quality differentiated nylon 6-FDY spinning project with a contract amount of 70.276 million yuan, accounting for 8.03% of the company’s audited operating income in 2020.

Zheng Jun, shareholder of Jinxin Nuo, pledged 6.7 million shares.

() Announcement was issued, and the company recently learned that some shares of shareholder Mr. Zheng Jun have been released from pledge.

This time, 6.7 million shares were released from pledge, accounting for 16.31% of its shares and 1.16% of the company’s total share capital.

Tianao Electronics’ related shareholders have reduced their holdings of 37,000 shares for more than half of the time.

() Announced, as of January 31st, 2022, the implementation time of the reduction plan has been more than half, and the supervisors and senior managers of the company, Huang Hao, Ye Jing, Yin Xiangyan, Chen Jing and Liu Jieji, have been more than half. On February 7th, 2022, the company received the notification letter from the above-mentioned personnel, and reduced their holdings by a total of 37,000 shares.

The plan to reduce the holding of 240 million shares by shareholders of Xugong Machinery, such as Taiyuan Investment, was completed.

() Announcement: Recently, the company received the Notice Letter on the Completion of the Implementation of the Share Reduction Plan issued by shareholders Taiyuan Investment and Taixi Investment. Up to now, the above-mentioned reduction plan has been implemented, and the above-mentioned shareholders have reduced their holdings of 240 million shares of the company, accounting for 3.06% of the company’s total share capital.

Huanrui Century bought back 10,116,700 shares at a cost of 33,995,600 yuan.

Huanrui Century announced that as of January 31, 2022, the company repurchased 10,116,700 shares of the company with its own funds through the company’s special securities account, accounting for 10,313% of the company’s total share capital. The highest transaction price was 3.50 yuan/share, the lowest transaction price was 3.18 yuan/share, and the total transaction amount was 33,995,600 yuan (excluding transaction fees).

Meichen Ecology: The subsidiary obtained the notice of designated development of the supplier’s project.

() On the evening of February 7th, it was announced that Shandong Meichen Industrial Group, a wholly-owned subsidiary, recently received a notice from a customer that Shandong Meichen Industrial Group had become a batch supplier of thermal management circulation system pipelines for a brand-new platform project of a domestic new power brand OEM. The life cycle of this project is 5 years. According to preliminary calculation, the total life cycle is about 387 million yuan.

Huanrui Century: The cumulative box office income of Bears Coming Back to Earth exceeded 562 million yuan.