The list of insomnia in milk tea attracts attention, and Xicha reveals the secret of caffeine in tea.

In the past beginning of autumn, the "first cup of milk tea in autumn" was once again screened. According to the data of Meituan, on the same day in beginning of autumn, Meituan’s take-out platform sold over 53 million drinks, up 34% year-on-year, and the sales of 10 brands exceeded one million drinks.

Greeting beginning of autumn with milk tea is a unique sense of ceremony for a new generation of young people, but after the milk tea carnival, some people began to regret it a little. The reason is that, in the words of netizens, "the first cup of milk tea in autumn became the first insomnia in autumn".

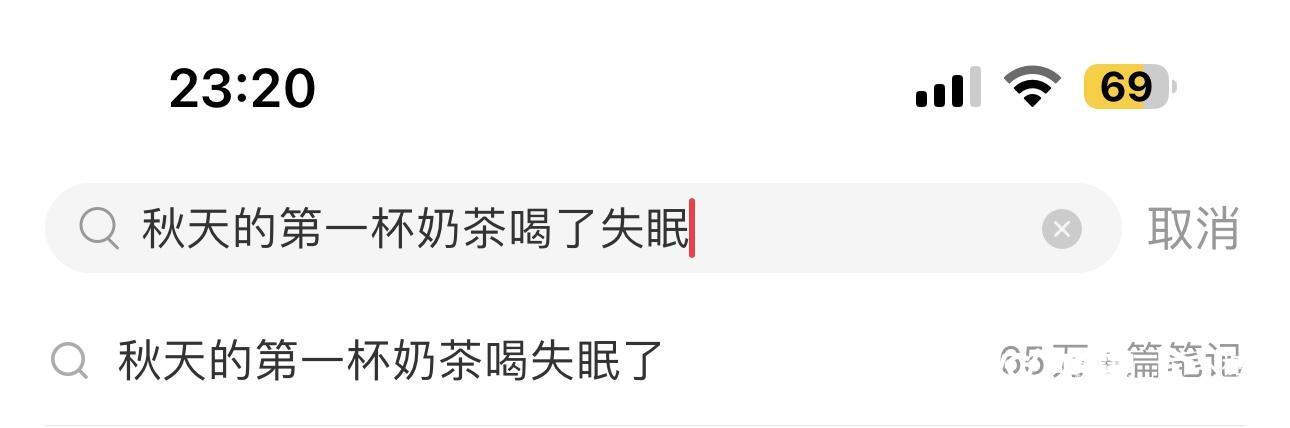

In Little Red Book, as of August 13th, there were more than 650,000 notes on the topic # Insomnia after drinking the first cup of milk tea in autumn # and as many as 380,000 notes on the topic #. Many netizens vomited in the middle of the night, "Tea is drunk at nine o’clock, and people haven’t slept until six o’clock", "I like drinking milk tea and staying up all night" and "Insomnia comes here to gather".

What puzzles many consumers is: Why is milk tea so refreshing?

The answer is that caffeine is naturally contained in tea, so caffeine is generally found in tea drinks containing tea. How much caffeine does a cup of milk tea contain? When can drinking milk tea easily lead to insomnia?

The Secret of Caffeine in Milk Tea

Is drinking milk tea easy to lose sleep?

"Milk tea insomnia list" attracts attention

Before "Caffeine in Milk Tea" caused concern, some netizens spontaneously started the "Milk Tea Insomnia Ranking" on social platforms. Because it is a subjective evaluation, the evaluation dimensions adopted by netizens mainly lie in insomnia times and insomnia time. For example, a certain milk tea drinks insomnia every time, a certain milk tea starts to feel refreshed in the afternoon, and a certain milk tea prolongs the sleep time by two or three hours … Some netizens spontaneously started the "Insomnia Milk Tea Collection".

Image source: social platform

Behind these competing "folk lists" is that with the increasing consumption of tea and gradually becoming a part of daily life, people are paying more and more attention to insomnia caused by drinking milk tea. At the same time, because the "factors" that cause insomnia in tea are not clear, consumers can only "cross the river by feeling the stones" and use their bodies to do tests.

In November last year, Bawang Tea Ji announced the caffeine content of some of her drinks. Subsequently, the caffeine content of her drinks exceeded that of Red Bull drinks, which caused a heated discussion. Red Bull Beverage, which claims to relieve fatigue, contains about 75mg (mg) of caffeine in 500ml of two cans, while the caffeine content in Boya Juexian, a 580ml classic drink of Bawang Chaji, is about 166mg. In this regard, some netizens commented that "it is the first time to know that milk tea contains caffeine content".

In May of this year, the topic of "Wan Li Mulan, whose netizens dominate Wang Chaji, couldn’t sleep after drinking" was rushed.The hot search list ranked first, and the reading volume of the topic exceeded 120 million. Bawang Chaji responded that the caffeine content of Wan Li Mulan is 235mg, which is equivalent to a cup of latte of the same specification.

In fact, many consumers don’t know that tea contains caffeine. According to the Survey on Consumers’ Cognition and Attitude towards Caffeine in China (2023) released by Kexin Food and Health Information Exchange Center in September 2023, 52.15% of the respondents did not know that tea contained caffeine. However, according to the countryThe dietary caffeine intake level of China residents and its risk assessment issued by the Risk Assessment Center in May 2021. In China, for adult consumers, the highest contribution rate of caffeine intake is tea, tea beverage, milk tea and coffee.

Because tea contains caffeine, drinks containing tea will inevitably contain caffeine. However, the caffeine content of different drinks still varies greatly.

From the "Collection of Insomnia Milk Tea", "Collection of Insomnia Milk Tea" and "List of Insomnia Milk Tea" spontaneously produced by netizens, it can be seen that consumers are not only eager to know the specific content of caffeine in milk tea, but also hope to know in a simpler and more intuitive way: How strong is a cup of milk tea? Is it easy to cause insomnia? Is it suitable for drinking? What time is suitable for drinking? To this end, some tea brands decided to respond to the demand.

The Secret of Caffeine in Milk Tea

Hi Tea Industry is the first to announce the "Caffeine Traffic Light" health label.

More than half of decaffeinated and labeled as "green light" drinks

On August 15th, Xicha fully publicized the caffeine content of the ready-made drinks currently on sale in WeChat applet, online store and cup labeling. From August 15th to 17th, consumers who buy any products of Hi-Tea can also receive a complimentary caffeine traffic light identification card with the order.

As a new brand of tea brewed with original leaf tea, the tea soup in hi-tea drinks naturally contains caffeine.According to the caffeine content, Xicha classifies the drinks into four levels: decaffeinated, green, yellow and red, where green represents caffeine content < 50mg/ cup, yellow represents caffeine content 50-100mg/ cup and red represents caffeine content > 100mg/ cup.

The grading results show that,Among the ready-made drinks currently sold in all stores of Xicha, there are 19 products with caffeine-free and caffeine content marked as "green light", accounting for about 53%., including most popular fruit tea products such as succulent grapes, succulent peaches and plums, succulent mangmangmang, and two 0-caffeine drinks, namely roasted brown sugar bobo milk and brown sugar bobo real milk; There are 8 products with caffeine content labeled as "yellow light", accounting for about 22%, including tea products such as Zhizhi Lvyan tea queen and pure Lvyan tea queen, and a small number of fruit tea products such as Qingti light lemon tea. There are 9 products with caffeine content marked as "red light", accounting for 25%, including American coffee drinks, lattes and some light milk tea products. The caffeine content of "red light" drinks is mostly within 125mg/ cup, and the highest caffeine content is 175.5mg/ cup.

In addition to helping consumers clearly understand the caffeine content of drinks through the "traffic light", Xicha also provides guidance on the recommended drinking time of each drink according to the principle of caffeine metabolism in human body and related research.Products with caffeine content marked as "red light" are recommended to be drunk before afternoon; "Yellow light" products are recommended to be drunk before evening; "Green light" products can be easily enjoyed anytime and anywhere; The two "0 Caffeine" products can be drunk even at night.

That is to say, consumers who are afraid of insomnia and are prone to insomnia should "brake" when they encounter "red light" products at night; When you encounter a "green light" product, you can "walk freely" without fear.

This drinking time guide is similar to the "milk tea insomnia list" made by netizens spontaneously, but the evaluation by netizens is subjective, because everyone’s physical condition and caffeine tolerance are very different, which leads to the evaluation list made from this. It can’t really and objectively feedback the actual caffeine content of drinks. However, the "Caffeine Traffic Light" logo and the suggested drinking time guide on the line after the evaluation by authoritative organizations are more objective, simple and clear, and the applicability is more universal, which reduces the difficulty for consumers to identify and choose caffeine drinks.

The Secret of Caffeine in Milk Tea

Tea becomes high-frequency consumer goods

Consumers are prone to excessive caffeine intake.

On the daily intake of caffeine, at present, the Chinese government has not issued the recommended standard, nor has it issued relevant laws and regulations on the labeling of caffeine content in freshly made tea.

In the international market, the recommended intake of caffeine is 300-400mg per day for adults. According to the Scientific Opinions on Caffeine Safety issued by the European Bureau in May 2015, the daily caffeine intake of children is below 3mg/kg, that of pregnant/lactating women is below 200mg, and that of adults (non-pregnant women) is below 400mg. A single intake of 200mg or less will generally not bring safety problems to healthy adults; The US Food and Drug Administration suggested that the intake of 400mg of caffeine for healthy adults is safe, but advised pregnant women to "try not to eat or eat less caffeinated foods and drugs".

Excessive caffeine intake does have an impact on the human body. Ceng Ting, an attending physician in the Clinical Nutrition Department of the Second Affiliated Hospital of Guangzhou Medical University, said that excessive caffeine intake will induce symptoms such as accelerated heart rate and palpitations, and it will also have a certain impact on the nervous system. It may also extend the time required to fall asleep; Long-term excessive intake can also cause an increase in blood pressure and blood sugar. Many studies have shown that it is relatively safe for most adults to consume less than 400 mg of caffeine a day, while those who are lighter or special people should choose according to their adaptability. For example, people with caffeine intolerance, pregnant women, menstruating women, children, patients with gastric ulcer/gastritis, etc., should consume less products containing caffeine.

However, with the increasing frequency of tea consumption, people’s caffeine intake may increase unconsciously. Last year, the research teams of Tsinghua University and Central University of Finance and Economics conducted a survey on 5,281 college students in Beijing. The results showed that 21.3% of the respondents drank 1 cup of milk tea per week, 21.3% drank 2-3 cups of milk tea per week and 20.6% drank 4-6 cups per week. Along with the high frequency of milk tea consumption, the discussion about "drinking milk tea for insomnia and palpitations" has also become a hot topic many times.

Research on Tsinghua University and Central University of Finance and Economics

In order to avoid drinking milk tea for a while and regretting after drinking milk tea, it is particularly important to master the specific caffeine content of each drink and take caffeine scientifically and reasonably to avoid its damage to the body, especially to sleep. Previously, Ding Guanghong, a representative of the National People’s Congress, had proposed grading the caffeine content in beverages. For prepackaged and bottled beverages, caffeine content should be added to the nutritional composition list of bottled beverages containing caffeine, and beverages with caffeine content exceeding 40mg should be marked; For take-away street drinking shops, caffeine labels can be affixed to menus and take-away cups.

Considering the universal tolerance of Chinese people to caffeine and the frequency of drinking, Xicha marked the caffeine content of its drinks, and classified drinks with a content greater than 100mg as "red light" drinks, which brought stricter standards. At the same time, under the psychological demand that consumers are generally afraid of insomnia when drinking milk tea, Xicha further provides guidance on the recommended drinking time of each drink according to the principle of caffeine metabolism in human body.

This is undoubtedly a pioneering move in the domestic tea industry. In this regard, Kai Zhong, director of Kexin Food and Health Information Exchange Center, believes that there is no mandatory labeling requirement for caffeine in existing drinks in China at present, and it is worthy of recognition that enterprises are willing to take the initiative to label it, which will not only improve consumers’ right to know, but also help them to arrange their diet and consumption rationally.

The Secret of Caffeine in Milk Tea

Visualization, health and standardization

Xicha promotes the continuous upgrading of tea industry.

With the gradual popularization of health concept and the rise of health awareness, consumers are now paying more and more attention to the ingredient list and ingredients of tea. As one of the head brands of new tea, hi-tea dares to be the first and has made many pioneering moves in promoting the health, transparency and standardization of drinks.

In October, 2023, Xicha disclosed the formula raw materials, nutritional components and traceability information of the products on sale, and simultaneously announced the main nutritional components of the drinks on sale, including calories, protein, trans fatty acids, fats, carbohydrates, etc. After that, "formula disclosure" has become a "standard" for all products of Xicha.

At present, there is no mandatory regulation on the labeling of ready-made and ready-to-sell foods in China. Judging from the existing policies and regulations, whether or not to disclose the formula information depends more on the new tea brand’s own considerations, and the extent to which the formula information is disclosed still depends mainly on the independent decision of the enterprise. Under the leading role of Xicha, other brands in the industry have followed suit.

On the basis of product transparency, Xicha continues to improve product quality and promote healthy drinks. In March of this year, Xicha and Pamela, a global top-stream fitness blogger, launched a series of products with "light burden recommendation". After that, Xicha also launched an all-round sugar control action. Since May 2024, Xicha has gradually launched a free "true zero calorie sugar" for fruit tea products, and launched a "+slow sugar succulent grape" made of low GI sugar raw materials, bringing more healthy product choices to consumers.

In July, 2024, Xicha also issued the enterprise standard of "Fresh Tea Drinks" based on "four truths and seven zeros". "Four truths and seven zeros" means that the fresh tea must be made of "real tea, real milk, real fruit and real sugar", and the products meet the requirements of "0 creamer, 0 essence, 0 fructose syrup, 0 non-dairy creamer and 0 hydrogenated vegetable oil.

Compared with other head tea brands, this standard is more detailed and strict, and it is called the strictest healthy tea standard in the industry. In this regard, some insiders pointed out that the standard of hi-tea has the role of a weather vane, which will drive other tea brands to gradually follow up and help promote the upgrading and development of the tea industry.

The latest caffeine "traffic light" grading label and drinking time guide are another pioneering move of tea-loving. Xicha hopes that through the active disclosure of its own product formula, it will bring consumers clearer tea drinking guidelines, continuously promote the healthy upgrading and iteration of products, and continuously promote the healthy level of tea products.

Text/Zhan Danqing