The man steals a car and sells it cheaply to reward the female anchor for listening to a sentence "thank you for the gift of the handsome guy"

Webcast is becoming more and more popular. It is the easiest way to get the attention of those anchors with high value and many talents. Although these gifts are virtual, they have to be bought with real money, which often costs hundreds of thousands of dollars, which is not a small amount.

Li, a 23-year-old, usually likes to watch the live broadcast of beauty anchors on YY live broadcast platform. In order to get the attention of female anchors, he even stole two new cars at the end of August and the beginning of September without any money, and used them to give gifts to the anchors after the sale. Although he got the anchor’s "thanks" in the network, in reality he was severely punished by law. On October 12, Li was arrested by the Yubei District Procuratorate for alleged theft.

The new car parking lot was stolen one after another.

Things should start from August 23rd. At 3 o’clock in the afternoon, in a new car parking lot in Yuelai, Yubei District, a brand-new Ford Mondeo car was started by a young man while waiting to be loaded with a transport vehicle. This guy is Li, who worked in the logistics company for two months and just resigned.

However, for others present, because there are many new cars entering and leaving the parking lot every day, the car keys are all left in the car for the convenience of transportation. They didn’t even notice that Li had driven away the car, and they wouldn’t have thought that he would never come back after driving away the car. After a while, everyone suddenly realized and rushed to the Yuelai police station to call the police.

Just as the police launched an investigation, after 9 pm on September 3, a new car was stolen from the parking lot again — — A Ford maverick SUV was driven away. Compared with the last time, the parking lot has also strengthened its prevention, putting all the car keys into an envelope and putting them in an office on the first floor.

That night, when Li saw that there was no key in the car, he went directly to the only lit office in the office building to find the key. Li knows that cars with high configuration usually use intelligent key. After he found a intelligent key, he went out and pressed the lock. After seeing a white maverick SUV light up, he ran over and drove away.

The police seized surveillance and arrested the suspect.

The market price of two stolen new cars is 189,000 yuan for Mondeo and 239,800 yuan for Maverick. The Criminal Investigation Detachment of Yubei District Public Security Bureau visited and retrieved the surveillance video along the crime scene through investigation, and found that the suspect Li drove near the Hongqi Hegou turntable after stealing the car for the first time, and also stopped at a restaurant.

"We immediately rushed to the restaurant to understand the situation, but we didn’t expect to get important clues." The police of the Eighth Brigade of the Criminal Investigation Detachment said that the suspect Li had worked in the restaurant, and Li came to borrow 100 yuan from his former colleagues to refuel.

Through the restaurant staff, the police learned about Li’s personal identity information — — 23-year-old from Shijiazhuang, Hebei Province, now lives in Chongqing. In addition, it was found that he had a criminal record of motorcycle theft in 2015 and had just been released from prison for half a year.

The police immediately launched a further investigation against Li and found that he had a recent online record in Tonglu, Guizhou. After driving to an Internet cafe in Tonglu, the staff was impressed by Li’s name. "Others charge 10 yuan and 20 yuan for surfing the Internet. He drives to surf the Internet and charges 2,000 yuan at a time."

On September 9, the police successfully arrested Li by squatting in the Internet cafe.

He sold more than 90 thousand yuan for two cars

Li confessed that both stolen cars had been sold. "When I was working in a logistics company, I found a regulatory loophole in the parking lot." Li said that it was precisely because no one would think that someone was stealing a car there, and the escorts and stevedores of different logistics companies didn’t know each other, so he succeeded easily twice.

After stealing the Mondeo sedan on August 23rd, he sent the message "Who wants a brand-new Ford without a license" on the Internet, and it wasn’t long before someone took the initiative to contact him. That night, Li sold the car for 36,000 yuan.

When stealing the Maverick SUV on September 3, Li took "order theft" and sold it at a low price of 58,000 yuan.

On September 20th, Yubei police drove nearly a thousand kilometers to Lianyuan City, Hubei Province, and successfully recovered the maverick SUV that had been transferred to four lanes in an automobile shop.

The police in Yubei have taken measures against the gang that contacted Li to collect and sell stolen cars, and the Mondeo car is still in the process of recovery.

Stealing a car is just to satisfy vanity

Why did Li steal a car? It turns out that everything is related to vanity.

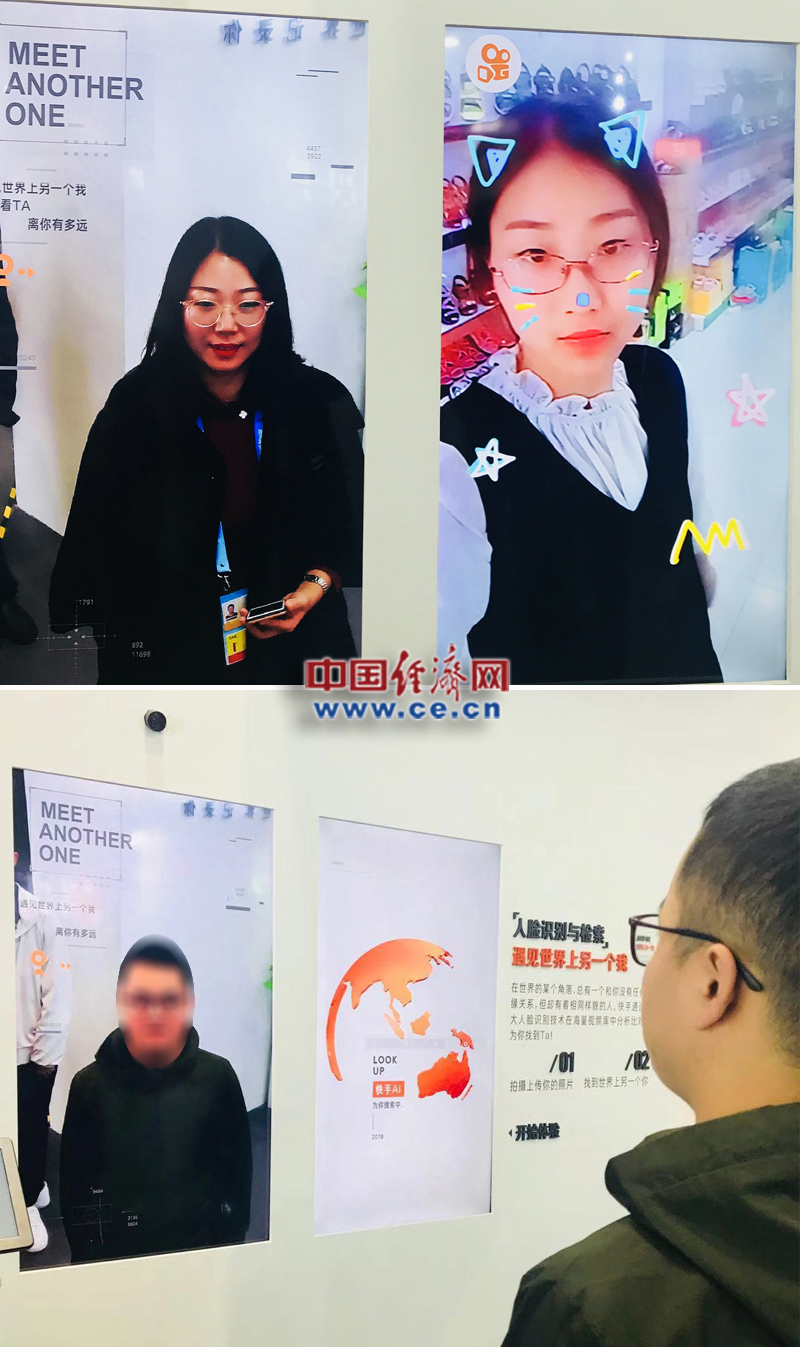

Li is an otaku, who usually likes to play games online. Recently, he has been fascinated by YY live broadcast. Watching female anchors sing and dance in videos and chatting with netizens, he also hopes that he can find opportunities to chat with these female anchors. Li found that some "local tyrants" netizens got verbal thanks from female anchors by brushing gifts for them.

"If she can thank me, then I will have a lot of face." With this idea, Li, who had no money, chose to steal a car. And take out 40 thousand yuan from the stolen money and buy virtual gifts for the female anchor.

Among the virtual gifts of YY live broadcast, the most expensive one is a luxury cruise ship worth 1314 yuan. Li has brushed this expensive gift for three female anchors, just to hear: "Thank you for the handsome guy’s gift, thank you!"

In addition, Li also bought an Apple mobile phone with the stolen money, KTV and clubbing with his brothers. Finally, he added some money to buy a used car and drove it to Tonglu, Guizhou. On the one hand, he avoided hunting, on the other hand, he found friends to play. When the police arrested him, he only had more than 1000 yuan left.

"It’s really the first time to steal money to reward a female anchor." After listening to Li’ s confession, the police were also stunned.

The police reminded that on the one hand, parking lots and logistics and transportation personnel should take care of new cars and keys; On the other hand, for netizens who like to watch live webcasts, the police suggest that rewarding anchors needs to be done according to their abilities, establish correct values and money concepts, and not be carried away by vanity. Our reporter Wang Zihan.