Send warmth to every village —— On-the-spot record of people’s resettlement in disaster areas

Xinhua News Agency, Jiuzhaigou, Sichuan, August 11th Title: Send warmth to every village — — On-the-spot record of mass resettlement in disaster areas

Xinhua news agency reporter

On the night of the 8th, an earthquake of magnitude 7 occurred in Jiuzhaigou County, Sichuan Province. More than 60,000 residents in Jiuzhaigou County, which was seriously affected, stayed up all night, and many people had difficulty returning home. How to ensure the basic livelihood of the people has become one of the biggest tasks besides rescuing the trapped people.

This is a great help that warms the heart. Tents, cotton-padded clothes, quilts, food, equipment and facilities … … Rescuers and materials from all directions are constantly gathering in the deepest part of the disaster area through the "life channel" that was rushed in time. Most of the affected people have food, water, clothes, covers and temporary safe accommodation.

Resident forces in sudden earthquakes provide disaster relief on the spot

"I feel like someone is shaking me hard behind my back!" 72-year-old Long Zhujie sat on a cane chair at the entrance of the tent at the Heyezhai resettlement site in Jiuzhaigou Scenic Area, recalling the scene at that time.

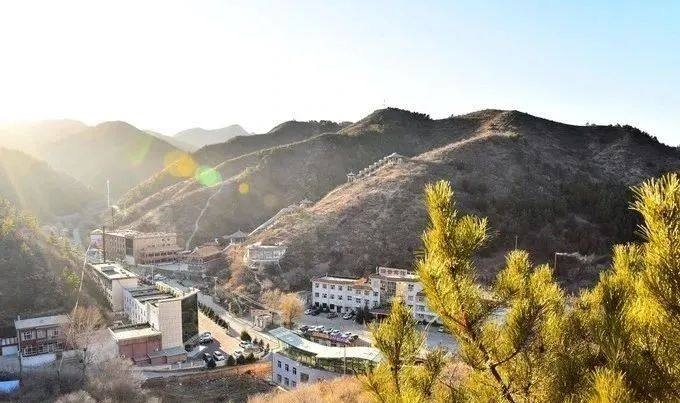

Lotus Leaf Village is less than 20 kilometers away from the epicenter, and its Jiuzhaigou Scenic Area is famous at an altitude of 2,000 meters to 4,000 meters. However, the traffic is inconvenient, the mountains are high and the valleys are deep, and there is only one road to the outside world, or Panshan Highway.

"With such a big earthquake, the Panshan Highway will definitely be interrupted, and the external rescue forces will definitely not be so fast. Our village Committee and more than 30 people spontaneously organized themselves and divided them into several roads to check the disasters such as landslides and water circuits, and evacuated the villagers to open areas such as basketball courts. " Awang, a villager from Heyezhai, said.

On the day of the earthquake, many houses in Zhangzha Town, Jiuzhaigou County collapsed and cracked, especially in the case of aftershocks, most residents were afraid to go home and stayed in the open area. On the cold night at high altitude, resident cadres, armed police and militia quickly acted to help appease and resettle the people.

"We are the armed police force closest to the epicenter. At that time, even our own camps were too late to check, so we quickly turned to villages to help the affected people." Liao Haizhou, a member of Jiuzhaigou detachment of Forest Sichuan Armed Police Corps, said that starting from Yongzhu Village, the team carried out search and rescue along the 301 provincial road in the direction of Chuanzhu Temple. As long as they met the injured, they would first pull back to the station to take care of them.

The rapid investment of the resident forces made the night of the 8 th "shock" relatively stable. On the other hand, disaster relief forces from all over the world are also trying to break through the road blocked by falling rocks and landslides, hoping to arrive as soon as possible, carry out rescue and deliver all kinds of relief materials. Because they know that there are still tens of thousands of people in Jiuzhaigou.

Aftershocks continued, and all forces rushed to help.

"Don’t take the refrigerator, grab the noodles and vegetables first, and then grab the pot." On the 10th, in Yongzhu Village, Zhangzha Town, more than a dozen officers and men of the Armed Police wore helmets and shuttled in front of some semi-collapsed buildings. Yan Li, chief of the Sichuan Forest Corps of the Armed Police, said that some residents were afraid to enter dangerous buildings, so they should help them rescue their daily necessities first for fear of being injured.

Although the magnitude of the earthquake reached 7, the buildings collapsed less and many necessities, including food, were preserved. As soon as the search and rescue work was over, some officers and men of Jiuzhaigou detachment of Forest Armed Police turned around and got into dangerous buildings to help residents grab out the necessities of life. In the whole disaster area, there are still many forces that are helping local residents tide over the difficulties in their own good ways.

"You reduce your stomach first, and your body will naturally be fine!" At the Heyezhai resettlement site, Ma Lizhi, director of the emergency department of the medical team of the National Rescue Team, just finished measuring the blood pressure of the villagers, saying that all the villagers who were injured during the earthquake have been treated, and now more is to check the villagers. At present, the medical team of the National Rescue Team has been divided into multiple channels to patrol the villages, and stationed personnel at multiple resettlement sites to pay attention to the psychological and physical conditions of the masses in real time.

"At noon, I ate self-heating rice, lived in a tent, and took out bedding from home. Everyone’s basic life is not much problem." Awang stood in front of piles of bread, mineral water, fruits and other relief materials and said. There are more than 600 people in the Heyezhai resettlement site. The food here was brought in from the outside in the past two days, and it will probably last for about two days.

According to reports, as of the afternoon of the 10th, 3,000 beds of quilts, 3,000 sets of cotton underwear, 2,000 tents, 1,000 folding beds and 3,000 sleeping bags have been dispatched to various resettlement sites. Flour, mineral water, self-heated rice, fruits and other foods with complete categories were also delivered to the people in the disaster areas. At this point, the basic livelihood of the affected people in the resettlement sites has been guaranteed.

Planning for future follow-up assistance is on the way.

"There are still frequent aftershocks, and these damaged buildings are definitely afraid to live in." At the resettlement site of Yongzhu Village in Zhangzha Town, 25-year-old Ren Jieya is having lunch with the villagers. She has not much confidence in when she can leave the resettlement site and return home to live. "My house is seriously damaged, and it must be demolished and rebuilt."

Although the resettlement sites have guaranteed the basic life of local residents, many residents are also confused about the future: where does the money for repairing houses come from? What about the tourism business? What will the family live on in the future?

In fact, what the masses are worried about is exactly what the government thinks.

— — The central government has urgently allocated 100 million yuan of living assistance funds for natural disasters, the National Development and Reform Commission has issued 60 million yuan of emergency subsidies, and the provincial finance has arranged 50 million yuan of special funds for emergency rescue. The assistance measures of government departments at all levels are precisely to solve the basic livelihood of the affected people during the transitional resettlement period.

— — Emergency headquarters, the earthquake site of China Seismological Bureau, has sent 16 disaster assessment teams with more than 80 people to carry out intensity assessment and disaster investigation in Jiuzhaigou earthquake-stricken areas. Recently, the Seismological Bureau will also release the earthquake intensity map. The intensity map will be a powerful basis for post-disaster assistance and reconstruction.

— — The restoration and reconstruction of Jiuzhaigou has been or will be carried out one after another. Roads have been rushed through, and work such as electricity, communications and the restoration of drinking water supply is under way; The post-disaster reconstruction planning and other supporting work of the scenic spot will be implemented item by item after the experts have completed the assessment of geological disasters, water cycle and ecosystem in the scenic spot.

… …

The support from all directions can help the affected people recover more quickly, but what is more important than this is the strength and efforts of Jiuzhaigou residents themselves. Fortunately, many residents in these resettlement sites have begun to take action. "As long as people are here, they will definitely get better gradually in the future." Jia Zuoman of the resettlement site in Zhangzha Village said. (Reporter Xu Wei, Ma Muwang Qing, Feng Qidi, Yang Di)