Wang Jianlin heaved a sigh of relief: PAG signed a new agreement with Wanda Commercial Management, temporarily easing the debt crisis

When Wanda Commercial’s IPO sprint was fruitless and the bet was facing default, Wanda Group Wang Jianlin could finally breathe a sigh of relief.

On December 12, 2023, PAG and Dalian Wanda Commercial Management Group jointly announced the signing of a new investment agreement. PAG will work with other investors to reinvest in Zhuhai Wanda Commercial Management after its investment redemption period expires in 2021.

The investment amount of existing investors in Zhuhai Wanda Commercial Management in August 2021 is about 38 billion yuan, of which the investment amount of Pacific Alliance is about 2.80 billion US dollars (about 18 billion yuan).

According to the new agreement, Dalian Wanda Commercial Management holds 40% of the shares, making it the single largest shareholder. Pacific Alliance and several other existing and new investors will participate in the investment, with a total shareholding of 60%.

Wanda will work with key shareholders such as Pacific Alliance to further optimize the company’s corporate governance, maintain the stability of the management team, and jointly support the company’s long-term development.

Wanda Group said that the new agreement reflects investors’ high recognition of Zhuhai Wanda Business Management’s growth potential and its operating capabilities.

Wanda Commercial Management expects annual revenue to 29.30 billion

According to the introduction, Wanda Commercial was established in September 2002 and is one of the world’s leading commercial property holding and operation enterprises. Zhuhai Wanda Commercial Management is the only business platform for asset-light operation and management of commercial centers under Dalian Wanda Commercial Management Group.

As of November 2023, Zhuhai Wanda Commercial Management operated and managed 494 large-scale commercial centers, of which 290 were commercial centers under Dalian Wanda and 204 were third-party asset-light commercial centers.

Zhuhai Wanda Commercial Management currently manages 494 large commercial centres in 227 prefecture-level and above cities across the country. The number of commercial centres managed by Zhuhai Wanda Commercial Management has grown from 417 to 494 in the past two years, an average annual growth rate of about 9%. Zhuhai Wanda Commercial Management is now the world’s largest commercial management company in terms of commercial area under management.

Since existing investors invested in 2021, Zhuhai Wanda Business Management has exceeded its performance targets for three consecutive years. After-tax income in 2021 is 23.50 billion yuan, 2022 is 27.10 billion yuan, and 2023 (estimated) is 29.30 billion yuan, with an average annual growth rate of about 12%. After-tax profit in 2021 is 5.30 billion yuan, 2022 is 7.50 billion yuan, and 2023 (estimated) is 9.50 billion yuan, with an annual growth rate of 34%.

In the past three years, Wanda Commercial Management has paid a total of about 10 billion yuan in taxes, and the dividends to shareholders are 4.60 billion yuan in 2021, 6.70 billion yuan in 2022 and 8.50 billion yuan in 2023 (estimated).

Tencent and Country Garden are shareholders

In 2018, Tencent Holdings, as the main sponsor, jointly signed a strategic investment agreement with Suning, JD.com, Sunac and Wanda Commercial in Beijing to invest in 34 billion and acquire about 14% of the shares held by investors introduced when Wanda Commercial Hong Kong H shares were delisted.

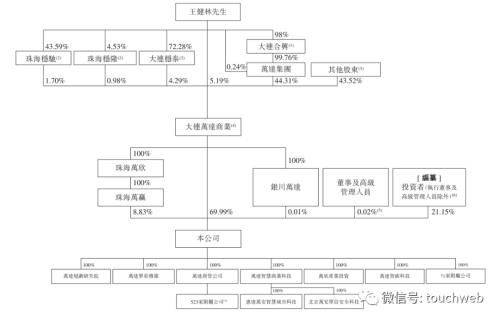

Before the Wanda Commercial Management IPO, Wang Jianlin directly held 5.19% of Dalian Wanda Commercial and 44.31% through Wanda Group. In addition, Zhuhai Wenchi held 1.7%, Zhuhai Wenlong held 0.98%, and Dalian Wentai held 4.29%.

Wang Jianlin holds 36.58 per cent of Zhuhai Wentai, 4.53 per cent of Zhuhai Wentai and 70.11 per cent of Dalian Wentai, which are shareholding platforms for employees of Wanda Group and its subsidiaries.

Wang Jianlin’s wife, Lin Ning, holds 3.18 per cent of Dalian Wanda Commercial; Wang Jianlin holds 98 per cent of Dalian Hexing and 2 per cent is held by Wang’s son, Wang Sicong. Dalian Hexing holds 99.76 per cent of Wanda Group and Wang Jianlin directly holds 0.24 per cent of Wanda Group.

Dalian Wanda Commercial holds a 78.83% stake in the joint stock company of Zhuhai Wanda Commercial Management Group, and investors hold a 21.15% stake in the joint stock company of Zhuhai Wanda Commercial Management Group.

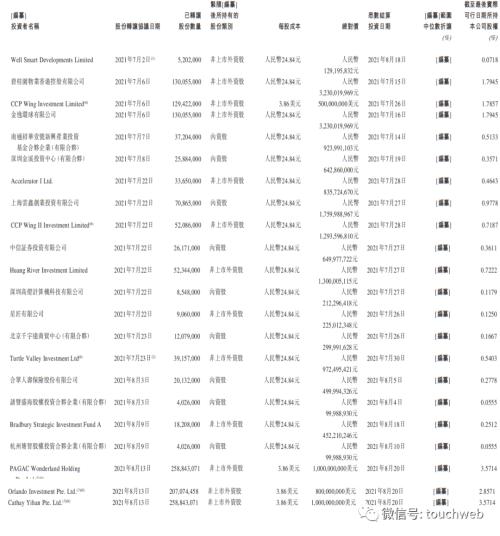

Country Garden holds 1.7945%, Chow Tai Fook’s WellSmart Developments Limited holds 0.0718%, CITIC Capital’s CCP Wing Investment holds 1.7857%, Jinyi Global holds 1.7945%, and Shanghai Yunxin Entrepreneurship holds 0.9778%.

Tencent holds 0.7222% through Huang River, Tencent holds 0.1179% through Shenzhen High Light Computer Technology Co., Ltd.; Ant Group’s Accelerator I holds 0.4643%;

PAGAC holds 3.5714%, CITIC Securities Investment Co., Ltd. holds 0.3611%, and Hangzhou Tangzhi Equity Investment Partnership (Limited Partnership) holds 0.0555%.

However, as investors in Wanda Commercial Management, Ning and Sunac have encountered operational difficulties to varying degrees. It is difficult for the Mud Bodhisattva to cross the river, but it is difficult to solve the problem. In particular, Ning also stepped on Evergrande, causing serious losses. Country Garden is also in crisis, and only Wanda is relatively better off.

Selling Wanda Films to Help Yourself

A few days ago, Wanda Film announced that it received a notice on December 6, 2023 that the company’s indirect controlling shareholder, Beijing Wanda Cultural Industry Group Co., Ltd., and its wholly-owned subsidiary, Beijing Hengrun Enterprise Management Development Co., Ltd., and the company’s actual controller, Wang Jianlin, intend to transfer the 51% equity of the company’s controlling shareholder, Beijing Wanda Investment Co., Ltd. to Shanghai Ruyi Investment Management Co., Ltd.

As early as July 20, 2023, Beijing Wanda Cultural Industry Group Co., Ltd., the indirect controlling shareholder of Wanda Film, signed an Equity Transfer Agreement with Shanghai Ruyi Film and Television Production Co., Ltd. (referred to as "Shanghai Ruyi"), and Wanda Cultural Group transferred its 49% stake in the company’s controlling shareholder, Beijing Wanda Investment Co., Ltd. (referred to as "Wanda Investment"), to Shanghai Ruyi. Shanghai Ruyi invested 2.262 billion yuan.

This means that once the transfer is completed, Shanghai Ruyi will hold a 100% stake in Wanda Investment Co., Ltd., and then hold a 20.03% stake in Wanda Film. Wanda Film’s actual control will change from Wang Jianlin to Shanghai Ruyi.

According to the financial report, Wanda Film’s revenue in the first nine months of 2023 was 11.348 billion yuan, an increase of 46.98% over the same period last year; net profit was 1.115 billion yuan; net profit after deduction was 1.10 billion yuan. Among them, Wanda Film’s revenue in the third quarter of 2023 was 4.479 billion yuan, an increase of 61% over the same period last year; net profit was 692 million yuan, and net profit after deduction was 689 million yuan.

Wang Jianlin once again "cut meat" to save himself is to deal with the delay in the listing of Wanda Commercial Management, and the company is facing a situation of default on gambling.