Opening speech

In order to implement the spirit and related requirements of the important speech made by the Supreme Leader General Secretary at the symposium of scientists, and vigorously promote the spirit of scientists, China Optics has opened a column of Interview with Academician since the first issue in 2021.

This column will combine interviews, self-reports and other diversified forms to record the unforgettable stories of academicians in their growth, teaching, scientific research and other experiences, as well as their understanding and thinking on life, science, education and other issues, so as to show the patriotic dedication and innovative and realistic spirit of the older generation of scientists.

Interview with Academician was carefully planned and organized by Chen Xingdan, an academician of China Academy of Sciences and a famous optical expert in China. Although Mr. Chen is over 80 years old, he personally invited academicians, called relevant editors to compile and sort out the final draft word by word. Mr. Chen’s hard work is the quality assurance of this column, which is deeply admired and respected by our colleagues.

The column "Interview with Academician" will continue to be carried out, and I sincerely hope that readers can get to know them and understand them through this column, so as to enlighten and gain something.

Editorial Board of China Optics

yanda liMale, Han nationality, born in Dongguan, Guangdong Province on October 12th, 1936. China is an expert in signal processing and bioinformatics, and an academician of China Academy of Sciences. Professor Tsinghua University, IEEE Fellow, Fellow of Chinese Institute of Electronics.

In 1959, he graduated from the Department of Computer and Automatic Control in Tsinghua University. He taught in Tsinghua University in July 1958 and retired in October 2018. From 1978 to 1981, as the first group of visiting scholars to the United States after the Cultural Revolution, he visited and studied at MIT. He has served as director of the Department of Automation of Tsinghua University, dean of the School of Information, director of the academic committee of Tsinghua University, member of the school affairs committee, and deputy director of the degree committee of Tsinghua University. In 1991, he was elected member (academician) of Chinese Academy of Sciences. He has served as a member of the State Council Academic Degrees Committee and convener of the evaluation group of control science and engineering discipline, director of the Standing Committee of the Information Technology Science Department of China Academy of Sciences, member of the Presidium of the China Academy of Sciences, director of the Teaching Steering Committee of Electronic Information and Electrical Science in Colleges and Universities of the Ministry of Education, and editor-in-chief of Electronic Journal.

Li Yanda has made important achievements in the theory, algorithm and application of DOA estimation and signal reconstruction. He proposed a new method of time delay estimation, which relaxed the application conditions of signal reconstruction theory. He introduced the theory of signal reconstruction and artificial intelligence technology into the processing and interpretation of seismic exploration data, and put forward a new method to predict underground oil layers by integrating seismic profile, logging and geological knowledge. He achieved a series of pioneering results and achieved remarkable results in practical application, which made an important contribution to the cause of petroleum geophysical signal processing in China. After 1998, he devoted himself to the research of bioinformatics. He regarded the genome as an information system, introduced the idea of information theory and complex system into the analysis of genome and biomolecular system, and made some research achievements in gene regulation analysis and modeling, theoretical analysis of traditional Chinese medicine, and analysis of diseases and targets. He is one of the pioneers in the field of bioinformatics in China.

I spent my childhood in war.

My father, Li Lurong, was born in Nanhai, Guangdong, and worked as a clerk in the administrative organs. Later, he joined relatives as a clerk in Shanghai. My grandfather was a former Qing Dynasty juren with a rich family. My mother, Zhang Ruiwen, inherited her grandfather’s wisdom. She went to school and worked as a primary school teacher. She is thoughtful and opinionated. When her father is away for many years, the whole family is fully supported by her mother.

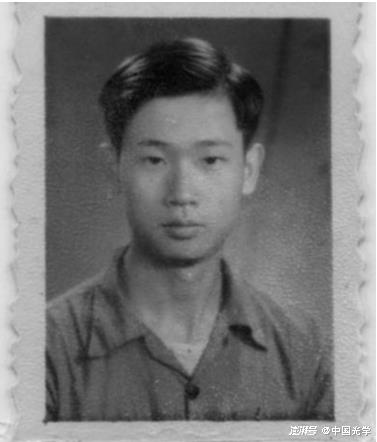

In 1936, I was born in my grandmother’s home-Dongguan County. I was the first child in my family, and soon I had a second one-my younger brother. I spent my childhood in war. I went to the third grade in Dongguan Yuanyong Primary School and moved to Guangzhou with my family to continue my primary school and junior high school. By the second day of junior high school, I was admitted to Guangya Middle School, which is a school that children from poor families hope to enter. From the second day of junior high school, I entered this boarding school until I graduated from high school, and experienced the liberation of Guangzhou (1950). After liberation, due to the financial difficulties of my family, I insisted on studying with the support of national grants.

Li Yanda as a teenager.

Second, unforgettable and elegant

Guangya Middle School, formerly known as Guangya Academy, was founded in 1888 by Zhang Zhidong, Governor of Guangdong and Guangxi Provinces. Its name is taken from "Broad people are great" and "elegant people are just", which means to cultivate knowledgeable and upright people. In Guangya Middle School, I learned to live independently, manage myself, develop freely and happily, and cultivate my good self-study habit and self-improvement spirit.

I am most interested in physics class.

I am curious by nature and like to explore the unknown. In Guangya Middle School, the course I am most interested in is physics. Mr. Wu Weitang, a physics teacher, gave a logical and fascinating lecture, which showed us a brand-new world. It is a great pleasure for me to borrow extracurricular books, especially reference books on physics. As a result, after a period of time, I couldn’t find any physics extracurricular books that I could continue to borrow in the middle school library. Reading extracurricular books makes me learn actively and deeply.

My diary recorded an impressive physics class. In that class, Mr. Wu asked questions for everyone to answer. "Now ask the fourth question, please answer it. What is the internal current of the battery? Ask Li Yanda to talk about it. " I have thought about this question for a while, and briefly organized what I want to say a few seconds before I stood up. I replied: "Charged ions are attracted by the electric field caused by the two poles and move regularly. Negative ions move to the positive electrode and positive ions move to the negative electrode to form the current in the battery." Teacher Wu kept nodding his head in agreement: "What he said is completely right, and his answer is very good and perfect. Let me ask another question, how to expand the meaning of the current in the conductor and combine the composition of the current inside the battery to summarize the meaning of the current? " Looking forward to everyone. I have been thinking about it for a long time, and finally I think that both electrons and ions are tiny particles with mass, which can be represented by particles. At this time, the teacher’s eyes looked at me and said, "Can you ask Li Yanda to answer this question again?" I stood up and answered briefly, "charged particles are attracted by the electric field and move regularly to form an electric current." Teacher Wu immediately nodded and said, "The answer is absolutely right and can be summarized. Have you thought that electrons are particles like ions? This answer is very good, very rare. Li Yanda must have read a lot of reference books beforehand, and he has a thorough understanding of this question. In the two years since I taught physics in senior high school, no one has given such a complete and comprehensive answer, which is rare. You all study hard at physics,But the power of generalization is not enough, so we should learn from Li Yanda, who summed it up very well. You should know that his answer this time is absolutely right. "Such a compliment is extremely rare for Mr. Wu. Extra-curricular books are really helpful to me. I have read some questions about solution current in extra-curricular books, and I have thought that ions may move. In physics class, the teacher mentioned that "in metal, current only moves electrons, and ions are stationary, but this is not the case in other objects." These words may sound like nothing to other students, but they touched my thoughts and confirmed my understanding. I answered the questions and answers in this class by combining reading extra-curricular books with my experience in class, because these questions would not be talked about in high school physics class at that time.

The habit of reading extracurricular books has benefited me a lot.

I read a wide range of extracurricular books, not only in physics. For example, I have read "A Brief History of Lenin’s Life and Career" and "Marina’s Life Path" and made notes. I wrote in my diary: "This book is so good that it gives me great enlightenment. I like reading books very much at this time. People simply can’t lack books. I especially like reading books about the growth of heroes, typical books about lofty morality, and I like those heroes. A person’s beauty lies not only in his appearance, but also in his heart and whether his character is noble or not. Marina’s goodness lies in her constant upward trend, loyal personality and brave and determined spirit. "

Every time I read a good book, I discuss the topic of life with my partners. Good books are so important to me that I sighed in my diary: "I can’t live without books for a day. The library is the most fascinating place. This feeling has been deeply felt as early as my freshman year." I love what Marx said: I would like to be a bookworm.

From now on, loving reading and reading all kinds of books has become my lifelong hobby, which has also helped me form a self-learning ability. In the first year of high school, I was hospitalized for nearly a month because of illness, and all the courses I missed were made up by myself. Especially when I was studying geometry, I read a book "One Hundred Ways to Solve Geometry Problems" in the hospital, and I actually kept up with the progress. I always feel that I don’t have enough time because I am interested in reading books. Although I also made a reading plan, I never finished it. In addition, as a monitor, I am busy with many things. Gradually, I am used to arranging my time effectively. I often pay attention to the main points and improve efficiency when doing things and reading books. This method is very effective when used in course study. After a class, I can often sort it out with a page, and it is easy to review. Therefore, even during reviewing for exams, I still find time to read extra-curricular books. This habit benefited me a lot in my later study and work.

Third, study in Tsinghua

In college, I have developed a unique set of skills of listening to lectures and reviewing.

After graduating from high school, I was admitted to the Department of Electrical Engineering in Tsinghua University.

I didn’t know Tsinghua University at first, and my first impressions were two: First, Tsinghua is a good place for diligent study, especially the library in Tsinghua University, which greatly meets my demand for books; Second, Tsinghua University’s teachers are very good, such as Mr. Zhong Shimo, Mr. Zhao Fangxiong, Mr. Tong Shibai, etc. They not only speak well in class, but also have outstanding personality charm.

In this demanding environment of Tsinghua University, I have not only laid a solid foundation in basic knowledge, but also developed my thinking method and learning method. Because of the great freedom and difficulty of studying in college, I have developed a unique set of skills of listening to lectures and reviewing in order to adapt to the tense college life. Because I am good at grasping the main points, once I grasp the main points in class, it is easy to understand; In the classroom, I often feel that there are many tedious and repetitive contents in what the teacher says. Just staring at the teacher will lead to low learning efficiency. It is better to use the time between lectures to compare the teacher’s methods with your own ideas and list your own doubts. In order to grasp the main points of classroom knowledge more quickly, I often take time to read more books and do some preview when reviewing. Five minutes before class, I will recall the preview content and get a general impression of the central content of this class. In this way, I think while listening, analyze while listening, and write down the main points and similarities and differences, which greatly improves the efficiency of listening to lectures. Over time, the classroom is no longer a place to memorize knowledge, but a place for me to do analysis and comparison. Therefore, I can often put forward some of my own views, and I can also integrate the knowledge of extracurricular books into the course content. Throughout one’s life, knowledge is accumulated slowly, and only the knowledge that one is very interested in and carefully thought about will be accumulated in one’s mind. It is not difficult to do this, as long as you have the heart and form a habit, the result will be inevitable.

Dialectics has opened a new window for me

My study habit of reading extracurricular books became an active part in extracurricular activities when I was in college. I remember when I was a sophomore, I took part in extracurricular scientific and technological activities about the essence of electromagnetic field. This is a study of the nature of matter. In some people’s view, the appearance of electromagnetic field makes matter "disappear". In order to discuss this problem, I especially studied dialectics of nature. I like reading Laozi’s Tao Te Ching very much. The dialectical thinking method has opened a new window for me. Without dialectical thinking, it is not only difficult for a person to enter the room in science, but also difficult to suffer setbacks in life. The dialectical thought makes me understand the dialectical relationship between success and failure, and between rise and fall, so that I can face failure calmly and attach importance to learning from it. When it goes well and rises, I often realize the crisis and make arrangements for the next leap. I can often analyze and observe a problem from the big picture and the whole, and look at new technologies and potentials from the perspective of development and change. All these have played an unimaginable role in my future work. Consciously combining dialectics with research work is also one of my most important gains in college.

After graduating from college, I spent seven years in scientific research, groping in practice, learning by doing, and learning what I can’t learn in books. Pay attention to the questions raised by practice, the research results should be applied to practice, understand the gap between book knowledge and practice, etc. These understandings and experiences were learned during this period, and I gradually matured in this way. Exploring the unknown and curiosity is my lifelong interest and pursuit, and it is also an endless driving force for forming a way of thinking.

3 broaden your horizons, climb high and look far.

With the increase of knowledge and the gradual expansion of the fields involved, my knowledge is also growing. I found that many things have similar properties and different fields have internal relations, and my horizons are gradually broadened, and my understanding and understanding of subject boundaries and subject development are also suddenly enlightened, and I gradually have my own insights.

I studied automatic control in college, and engaged in electronics and digital control for more than ten years after graduation. In 1959, I took part in the maintenance and operation of the first machine tool program control computer in China. Although a group of young people in Tsinghua knew little about program-controlled computers at that time, a group of young people who dared to think and do it could design and manufacture program-controlled computers by themselves after a year or two of hard work. This has greatly inspired me to further emancipate my mind and dare to think and do it. Then I led the graduate students to develop the first program-controlled computer of drilling machine in China and put it into production.

Four, MIT for two years.

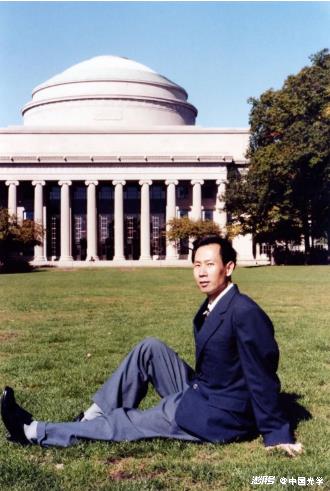

In 1978, I passed the exam and became the first group of visiting scholars to the United States, and had the opportunity to study at the Massachusetts Institute of Technology (MIT). For some other reasons, my research direction shifted from electronics to signal processing. Although I have only been at MIT for two years, I have gained a lot. The most important thing is to broaden my horizons, and at the same time, I have entered a new research field and found a new direction.

In January 1979, Deng Xiaoping (second row, fifth from the left) cordially received the first batch of Chinese students studying in the United States in the new era at the China Embassy in the United States. The third row from the left is Academician Li Yanda.

I used to major in electronic circuits, and I worked under Mr. Tong Shibai. Before going abroad, Mr. Tong arranged for me to learn microprocessor, and asked me to open this course when I came back. At that time, going abroad required two people to write letters of recommendation. I found Mr. Chang Yong, who is a master of MIT and a doctor of Harvard. Mr. Chang asked me to learn signal processing and bring back the class. So it is written on the application form: the first volunteer microprocessor, the second volunteer signal processing.

The tutor I originally chose when I went to MIT was Professor Fan Li, who was the director of the MIT microprocessor laboratory. However, it was the first time that New China sent visiting scholars to the United States, and several institutions did not make it clear that they would accept these people, including MIT. It is said that when MIT professors discussed whether to accept these visiting scholars, Mr. Lin Jiaqiao urged them to accept them. However, some Jewish professors who are very influential in MIT raised some difficult questions. For example, they suggested that the basic condition for visiting scholars is to have a doctorate, and none of these Chinese have a doctorate, so they can only come to MIT as students, not as visiting scholars. As a student, you have to pay tuition, which is actually not accepted. Mr. Lin Jiaqiao argued that there was no doctor’s degree in China, and emphasized that the level of these people met the requirements. The two sides were at loggerheads, and finally a Jewish professor named Oppenheimer proposed a compromise: let them come in first and see before deciding. Finally, MIT professors decided to conduct an investigation for one year. If these people are qualified, they will be treated as visiting scholars, and if they are not qualified, they will be treated as students and receive tuition fees. Because it was Professor Oppenheimer who put forward this suggestion, he would set an example to receive a Chinese and then report the assessment results to other professors a year later. He is an expert in signal processing. After reading the application materials of all visiting scholars, he found that only I chose signal processing. Although it was his second choice, he chose me. So when I came to MIT, I was assigned to Professor Oppenheimer.

I was 42 years old that year, the same year as Professor Oppenheimer. The first time we met, I told him: We graduated from university in the same year, but I just went through the Cultural Revolution for ten years, and you studied for a doctor and opened up your own research direction, so the two of us have been separated for more than ten years. At that time, my first task was to learn the course well, and I could continue to offer this course when I returned to China.

It is not easy to study in Professor Oppenheimer’s laboratory. I have never seen the computer system in the laboratory and I don’t know how to operate it. Once I was studying the instruction set and tried the functions of each instruction one by one. The last instruction was: Shut down. As soon as I executed it, I shut down the computer system of the whole laboratory. At that time, the whole laboratory was in an uproar, and some people had opinions and opinions about Chinese. But then one thing changed my situation.

Although I switched to signal processing from Professor Oppenheimer, I still have the task of learning microprocessor. During the summer vacation, Professor Fan Li’s laboratory provided an Intensive Course on microprocessors. For one and a half months, more than 30 senior engineers attended classes. The process of learning this course was very tight and the homework was very heavy. At that time, my English was not good and I didn’t understand it very well. The final exam is to give each of these more than 30 people a chip, and ask everyone to build a circuit by themselves. If they can read the information in the chip and display it, they will pass. I am very familiar with the circuit. I was the first to make it in two or three days and passed the exam, which surprised some people. The tutor of this course is a graduate student, who is in close contact with Professor Oppenheimer’s laboratory, and the news spread. Since then, the attitude of people in Oppenheimer’s group towards me has changed greatly.

After spending half a year in Oppenheimer’s group, I taught myself two or three courses, such as Signal Processing, by reading books and watching videos. Feeling that I should do scientific research, I went to Professor Oppenheimer and said that I would take part in the scientific research work in the group. Professor Oppenheimer was very surprised. He always thought that I would only take courses, so he asked me which research group I wanted to go to. I chose seismic exploration. Professor Oppenheimer said that he would have a look at it first, and gave me a topic, asking me to find information to do the calculation myself. A week later, I handed in the results, and he gave me another doctoral thesis for me to read. After more than a month, I understood the paper and put forward my own suggestions for improvement, which made me enter his research group. Professor Oppenheimer is an expert on how to apply phase spectrum. At that time, I realized that phase spectrum is closely related to wave delay, and the information of stratum structure can be obtained by using wave delay. My work has also given Professor Oppenheimer a new experience. It turns out that the phase function he proposed can also be used in the study of wave delay and geological structure. Professor Oppenheimer recognized my work, and our group of people also performed well in their respective fields. Therefore, we were all treated as visiting scholars without paying tuition fees, and later MIT accepted new visiting scholars.

Before going abroad, I was mainly teaching in Tsinghua, and my research was mainly tracking and imitating. Only at MIT did I understand how to do scientific research-make new things! During the two years at MIT, my research shifted from electronic circuit to signal processing, which opened up a new research direction and also learned to consider problems from a higher level. Whether it is electronic circuit, signal processing or feedback control, it is actually a problem of information transmission and processing. From a higher level, they are interlinked. I later studied the Internet from the perspective of information control to solve the congestion problem. The essence of bioinformatics is to study the inheritance of DNA information, and information inheritance determines material inheritance. The essence of life is also an information process. All my later work was carried out along such a line.

MIT’s two-year visit has greatly broadened my horizons, made me see the rapid development of foreign science and technology and our backwardness, and strengthened my confidence in emancipating my mind and daring to think and do. However, the most important harvest is: I stand at a different height and have the feeling of climbing high and looking far.

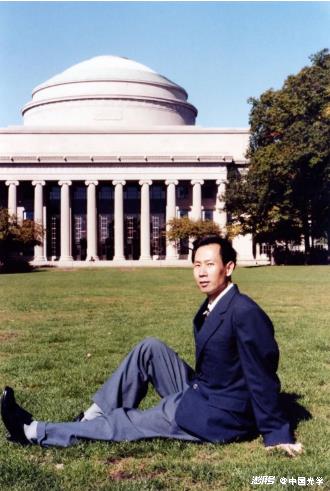

Academician Li Yanda is at MIT campus

Five, after returning to China to explore a new way of seismic exploration data processing technology.

After returning to China, I devoted myself to using new signal processing methods to find oil and natural gas for the country, that is, data processing for oil and gas exploration. It is very complicated and difficult to process a large number of oil and gas exploration data by computer to find oil layers buried thousands of meters underground. There are several ways to find oil and gas now, mainly by the so-called "seismic exploration" method. Geologists usually analyze the conditions of oil generation and accumulation in areas based on geological surveys, and then generate seismic waves through artificial explosions in areas where oil generation and storage are possible. The seismic wave propagates downward to several thousand meters of oil layer and then reflects to the ground, and the reflected wave can be received by installing a geophone on the ground, and then the cross section of the underground structure can be obtained by computer processing. Geological engineers analyze these structures, find structures that can store oil according to experience or known knowledge, and finally confirm them by drilling wells. However, in the early stage of exploration, the success rate of well drilling is often very low. Our task is to assist geological engineers to better judge oil layers and improve the hit rate of well drilling. Processing exploration data by computer developed greatly in 1960s and 1970s, and achieved great success. By the 1980 s, this method had become more and more complicated, and the results achieved were getting smaller and smaller.

After a period of research, although we made great efforts, the results were not very satisfactory, and I began to rethink the route of our work. My thinking is not limited to the specific topic at present, but the whole exploration method. I think the well location determined by seismic exploration often fails to produce oil. What is the fundamental reason? My conclusion is that the main reason is not that the computer processing is not fine enough, but that the data obtained by seismic exploration is not enough to determine the location of underground oil layers. From the point of view of information theory, it is a problem of insufficient information. For this problem, no matter how to study the computer processing method, it can’t be solved. The basic way to solve this problem is to increase the amount of information, that is to say, to supplement new knowledge about underground oil layers from other aspects. The more such knowledge is supplemented, the more effective it is to solve the problem. When I look around the whole process of exploration, I find that there are several important ways to understand the underground oil layer: one is that drilling wells and logging provide local detailed information of the underground; The other is the inference and analysis of underground oil layers by geological engineers according to geological conditions. Then, isn’t it just to solve the problem of insufficient information by incorporating logging data and information provided by geological engineers’ experience into seismic exploration data? However, because geology, logging and seismic exploration technology are all very complex disciplines or technologies, and they are self-contained, usually an engineer only knows one of them, and the separation of disciplines has caused the separation of the three to a certain extent. Secondly,There are also great differences among them in technology. The knowledge of geological engineers is vague and it is difficult to describe them accurately and quantitatively. The resolution of logging data is very high, but it is only a "one-hole view" with a narrow spatial scope; Seismic data has a wide range in space, but its resolution is low in local depth. More importantly, the amount of seismic data is huge, which needs to be processed by a large computer. The processing process is complex and it is difficult for manual intervention. It is very difficult to combine other data on a large computer. Therefore, when I realized that if we can combine the knowledge of logging and geological engineers with seismic data, it is possible to achieve new results, I began to consider how to realize this scheme. However, when I asked some experts to integrate the three, most of them shook their heads and said it was difficult. It is not easy to realize the integration of the three under the environment and limitation of large computers.

In the mid-1980s, when Professor Chang Yong came back from a visit abroad, he told me excitedly that a new type of computer-workstation appeared abroad. Its performance is equivalent to that of medium-sized and large-sized computers, but it is small in size and easy for manual operation and human-computer interaction. I immediately realized that a rare opportunity came-it must be possible to realize the combination of the three on the workstation. I have a premonition that the traditional seismic exploration data processing technology is coming to an end, and it is necessary to make bold decisions and embark on a new road. This is the combination of the above three. This analysis has strengthened my determination to overcome all difficulties and embark on a new path. After several years of hard work, my graduate students and I have opened up a new road, and initially realized the combination of the three, and the effect is obvious. Three new high-yield wells have been drilled in Shengli Oilfield by this new method. At the same time, the international community is developing in this direction. At present, it has become a common working mode and an important means of oil and gas exploration to process seismic exploration, geological engineer interpretation and logging data at the same time on the workstation, and to interact or combine them with each other.

Six, some experiences of scientific research work

1 don’t do what others have done.

When I was doing research work at MIT, I had the opportunity to get in touch with Professor Lin Jiaqiao, a famous scholar. He is a scholar I admire very much and his contribution to mathematics is universally recognized. I asked him what he should pay attention to in learning and what suggestions he had for my future research. He told me, "Don’t do what others have done." This sentence is very enlightening to me. I understand what he said, but it doesn’t mean that you shouldn’t do what others have done. If you want to learn and understand a lot of work, you must repeat what others have done. It goes without saying that a lot of development and production work is done on the basis of others’ work. I think the original intention of his words is: the research topic and research goal you have determined should be unprecedented and truly exploratory and pioneering. If we only repeat and make some repairs on the basis of what others have done, it is of little significance in research and will only waste a lot of energy, which should not be valued by a scientific researcher.

At the beginning of my scientific research work, I only took part in existing projects or worked with teachers, but I didn’t seriously consider this problem. When I came back from the United States in the early 1980s, my horizons and the height of seeing problems were different. Professor Lin Jiaqiao’s instruction can be said to hit the nail on the head, which has raised my research work to a new level. It is from the basic point that "no one has done it" that I set my research objectives and methods. Compared with the past, they all went all out, but the results were very different, which really benefited a lot.

Grasp the key and go all out.

I also adopt the methods used in my study when dealing with research work. When the research topic is determined, I am used to grasping the main points and key points, simplifying the problem into one or two key problems, and then going all out to concentrate on solving it. Because the problem is concentrated into one or two key problems, all your energy can be focused on one or two points, forming great penetration like an awl. For example, when I was studying signal processing methods at MIT, my professor was a famous scholar in the field of signal processing, and his research work reached the most advanced level in the world at that time. As my foundation is weak, he hopes that I can take more courses and learn more about the work done by his doctoral students. But I think "nothing ventured, nothing gained". I should not only learn advanced theories and existing achievements, but also be able to apply and even develop them and create something. This is my goal. According to my analysis, the instructor has made new innovations in signal reconstruction, and the most important point is to reconstruct the signal by using the phase function. I will seize this point and study it in depth; On the other hand, I choose oil and gas exploration data processing as an application field, and a key problem to be solved in this application field is the delay of finding the arrival time of signals. I vaguely feel that there is some connection between the two. After repeated thinking, I find that the arrival time of the signal is determined by the phase function, so the phase function can be used to determine the delay time in essence. I was very excited to find this internal relationship, and then I repeatedly thought about how to express the relationship between the two in mathematics, starting with the establishment of the model.To write general expressions. After continuous thinking, I finally found a new method and a new expression to estimate the delay problem by reconstructing the signal with phase function, and proved the feasibility of this new method with simulation data. This achievement made the guidance professor very happy, and personally took me to the relevant research center to report this achievement and write it into his summary report. Later, this achievement was also published in internationally renowned journals. Grasping the key and going all out, this method not only benefits me greatly in my study, but also is the most important weapon in my research work.

Put forward new goals in time, not afraid of failure.

A discipline has its process of occurrence, development and decline, and a person engaged in research in a certain field has to go through a similar process. When a person reaches the peak of his success, it also means that he may go downhill. At this time, he should be alert, have a sense of crisis, and set new goals for himself in time. In addition, I think, if you want to explore, don’t be afraid of failure. My first success is often based on dozens of failures. I am not afraid to admit defeat. When I put forward some new ideas, I am often ridiculed, opposed and sometimes even sharply criticized by some people. I don’t care about any of this, I just laugh it off. I think this is one of my great advantages.

Why am I always exploring? I think on the one hand, it is out of curiosity, and on the other hand, I see greater opportunities. Since I returned to China in 1981, I have been mainly engaged in seismic exploration data processing for more than ten years. My team has made some achievements after many twists and turns in its research work since childhood. Since 1993, when my research achievements were rewarded and I was undertaking larger projects, I felt that my work in this field for more than ten years had developed from the beginning to a peak and was going downhill. I have a sense of crisis, and I think it’s time to set new goals for myself. My feeling tells me that network information is a rapidly developing new field with a lot of opportunities. Therefore, I set out to set up a network information research group to apply the intelligent information processing methods we have studied for many years to network control and network information retrieval. Although we are beginners in network information, we have accumulated many years of knowledge in intelligent information processing and intelligent control. The establishment of this research group has given us new goals and inspired our new research ideas. With the development of the Internet in the world and the information superhighway in China, our new network information research group has also developed rapidly, attracting a group of promising young people, and our research has also achieved rapid results and published papers in important publications at home and abroad. Since 1996, with the implementation of the human genome project, a large number of genetic information and data have emerged, which urgently need further analysis by information scientists.The research of bioinformatics will be an important topic in the 21st century, and our other bioinformatics research group is also working closely with biologists to conduct new research.

In my opinion, the interdisciplinary and interdisciplinary edge is exactly where we can make great achievements. In the information age, we should not be complacent and arrogant, but be very sensitive, pay great attention to the development of world science and technology, make full use of the information obtained from all over the world through communication and opening up, and keep up with the times.

4. Establish an ideal, scientific and democratic team.

Nowadays, scientific research is always a collective behavior. The combination of experience and insight, acumen and diligence can often be more fully reflected in a group. A promising scholar should also be an organized person. Because I often serve as a monitor and a league branch cadre in middle schools and universities, I have cultivated my ability of unity and organization, and accumulated experience in social work for my future study and work. Teacher Chang Yong placed great expectations on building an ideal, scientific and democratic team, and also did a lot of work, which also had a great impact on me. We bring the spirit of daring to challenge the world-class level to the research group, set high standards, encourage exploration, allow failure, promote democracy and discuss on an equal footing in the research group, and gradually form an atmosphere. Through the efforts of the whole group, we have established a common goal and established national self-confidence and pride. Here, as an organizer, it is most important to have ideals and beliefs, perseverance and disregard for personal gains and losses. Fortunately, I often work in such a group, which is often the source of my innovative ideas and inspiration, and the most sensitive part of my vision and touch. It is great fun to do research and exploration in such a young group.

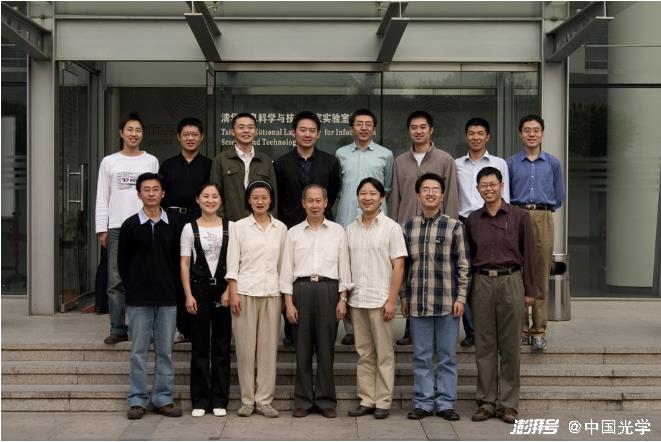

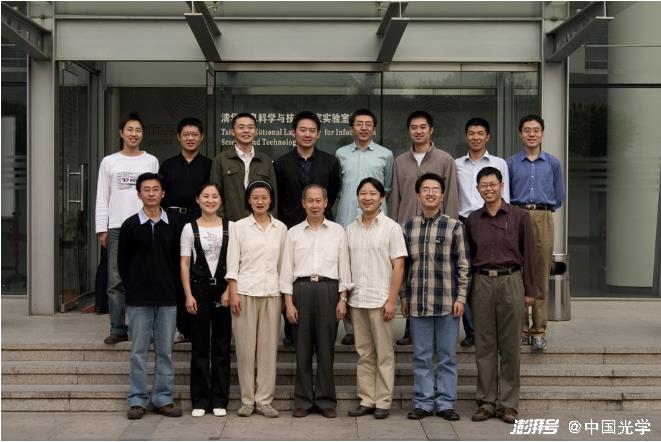

Academician Li Yanda and his graduate students (Tsinghua University)

5 About basic research

A problem that has been puzzling China’s scientific and technological circles is that science and technology and economy are two skins, and the two cannot be well combined. Over the years, we have always emphasized that "tasks should bring disciplines" and "science and technology should serve the economy", and we have taken many measures, but there are not many original achievements in innovation, and there are still "two skins" in the combination of science and technology and economy. If we have found the problem and attached great importance to it, it has not changed obviously for a long time, then it is likely that we have a problem in the guiding ideology of solving the problem.

When the Second World War came to an end in 1944, people were thinking about how to change science and technology from serving war to serving social development in peacetime. At that time, President Roosevelt gave this task to Dr. Bush, director of the American Scientific Research and Development Agency. After in-depth study, Dr. Bush and a group of outstanding experts put forward a report-"Science-endless frontier". This report has a great influence on the scientific research and economic development of the United States in the following decades. During this period, American science and technology have been at the forefront of the world, and the American economy has been constantly innovating and developing rapidly with the support of science and technology. When our country begins to get rid of the strong external pressure and various wars and carry out reform and opening up in a relatively peaceful environment, it is worth studying the experience provided by this report.

The main focus of this report is on the importance of basic research, which points out that basic research will lead to new knowledge. It provides scientific capital, and it creates such a reserve from which the practical application of knowledge must be extracted. New products and new technological processes are not completely mature as soon as they appear. They are based on new principles and new concepts, which are painstakingly developed in the research work in the purest field of science. Today, basic research has become the leader of technological progress, which is more clear than ever. A country that relies on other countries for new basic scientific knowledge will have a slow industrial development and a weak position in world trade competition, no matter how sophisticated its mechanical skills are. The report requires that the government’s funds for basic research must maintain a steady increase trend. Dr. Bush also pointed out that basic research should be given special protection and special guaranteed support. In 1968, when the US Congress authorized the National Science Foundation to support applied research in addition to basic research, Bush’s Committee on Science and Public Welfare warned that there is a tenacious law governing scientific research: under the pressure of demanding immediate results, applied research will inevitably exclude pure scientific research unless well-thought-out policies are formulated to prevent this from happening. The lesson is clear: it is pure scientific research that deserves and needs special protection and special guaranteed support.

The report also pays special attention to personnel training. In the part of "Renewing our scientific talents", President conant is quoted as saying: "-In every aspect of the whole field that can be properly called" science ",the limiting factor is people. The speed of our progress in a certain direction depends on the number of truly first-rate talents engaged in the said work. So in the final analysis, our basic education policy will determine the future of this country. "

As for strengthening industrial research, the report points out that "the simplest and most effective way for the government to strengthen industrial research is to support basic research and develop scientific talents". The report points out that "one of the most important factors affecting a large number of industrial research is the tax law", and the report suggests that the domestic tax law should be revised to eliminate the uncertainty of deduction of research and development funds.

I think it is clear that we can learn something from this report. The frontier of science and its potential benefits are still endless.

Seven, about personnel training

1 Character, knowledge and talent

Talent cultivation and postgraduate education have always been my thoughts. What do students want to learn in school? I once said the following words to the first-year graduate students of automation department:

Comrade Gao Shiqi, an old senior in Tsinghua, wrote the following words when he returned to Tsinghua in his later years:

"tsinghua campus studied for eight years, and welcomed the new year after 60 years of hard work.

Today’s dedication stems from yesterday’s learning.

The achievements of old people come from little diligence. "

It seems that only by being good at learning can you be a good graduate student, and only by being good at learning can you constantly strive for self-improvement and progress.

What should I learn during my graduate studies? I think we should learn "character, knowledge and talent" in reading and research.

Among them, the most difficult and useful thing to learn is character, followed by knowledge and talent. In fact, Tsinghua’s greatest influence on people is Tsinghua people’s character. During the summer vacation, many visitors to Tsinghua asked me where the moonlight was on the lotus pond in Tsinghua. Moonlight in the lotus pond shows Tsinghua people’s elegant sentiment, while Mr. Wen Yiduo’s angry behavior shows Tsinghua people’s integrity and backbone. What impressed our generation the most was Mr. Wang Ganchang. When the organization wanted him to participate in the development of an atomic bomb to counter the nuclear threat of the United States, Wang Ganchang’s answer was: "I would like to make my country." This reflects Tsinghua people’s life goals and traditions. Sentiment, righteousness and ideals of life have influenced generations. If you don’t improve your character, you have never read. This is just as the great scholar Cheng Hao said: "Today people can’t read. If you read the Analects of Confucius, you are such people when you don’t read it, but only such people after you read it, that is, you have never read it. " I hope we can improve our character by reading.

Secondly, what I want to say is to improve my knowledge. This includes knowledge and knowledge. In my opinion, knowledge is easy to learn, but knowledge is hard to find. There are different realms of knowledge.

Mr. Yu Youren wrote two poems:

"Let the cranes fly for thousands of hectares, and fish for a bay."

These are two kinds of realms, a crane soaring into the sky, and the eyes are all over the world. And fishing is just in the river bend. Only with such vision can we have such knowledge. Generally speaking, as Professor Huang Ziqing said, science can only ask "How", not "why". The students joked that science can only say "good" but not "bad". But I think science should be able to ask both "How" and "Why".

But if you ask "Why", it is often a bigger question. Its thinking needs vision, knowledge and imagination, and there is often no answer. Because if you ask "Why", you may ask "Tao". I have a saying, "Tao can be Tao, but it is extraordinary." On a smaller scale, if you take problems that others don’t know or can’t solve as your research direction, you need knowledge and imagination.

If reading and research can not only learn knowledge from teachers and classmates, but also increase "knowledge", it will be "trip worthwhile".

The third is talent, that is, the ability to solve practical problems. Be able to communicate with others, be eloquent, be reasonable, respect others, be good at uniting people and so on. Some people do everything smoothly, and some people can’t do anything. This is the performance of ability.

Some people say that as a graduate student, a good paper is everything. However, how do good papers come out? If you really do research, you are actually exploring in unknown areas. The process is like groping for the exit of a house in the dark. You often hit the wall everywhere, but the door may be at your hand, and you just pass by. At that time, you may be very upset or even very disappointed, so I suggest you, if you are strong enough, stick to it. Or, you may think it’s an act of god, go back to the dormitory and sleep. It’s also feasible to change the house and look for it next week. But never fake or copy. According to my experience, 80% of the time, "God" will give you an exit.

Because most of our research can only be regarded as "fishing in a stream", rather than traveling around the world like a crane, it is not difficult to find an exit. However, character, knowledge and talent are not given by "God". Only these three things are the true meaning of being a successful person and the ability to help you find an exit forever. I hope everyone will pay attention.

2 Postgraduate education should really face the future

Why is it that China has always imitated and tracked more, repeated scientific research at a low level, created less independently, developed new frontier disciplines slowly, and had few top-notch talents at a high level, especially those who led the development of a discipline? In my opinion, in addition to being limited by China’s economic development level and insufficient investment, graduate education should also bear part of the responsibility.

Talents in new frontier disciplines should be trained among graduate students, not just those in existing disciplines. Graduate students will be brought to undergraduate education when they are mature, thus promoting the renewal of undergraduate courses.

It is a well-known problem that the subject content of undergraduate education in China is slowly updated and the content is aging. The root cause is that graduate students have not made great efforts to cultivate new talents in frontier disciplines. With the development of new subject areas, new subject leaders will naturally appear, which is handsome. We are top-notch in the field of science and technology, and there are few talented people who have a great influence in one field, which is also related to the inability to sensitively cultivate talents in new disciplines in the future in graduate education.

Everyone knows that there will be a large number of breakthrough topics from interdisciplinary subjects, but in the past, we often lamented the difficulty in the development of interdisciplinary subjects and attributed it to the imperfect management system. In fact, fundamentally speaking, the guiding ideology of postgraduate education does not really face the future. This can be said to be an important issue that affects the quality of postgraduate training and the training of real talents. This is not a question of specific management methods, but a question of ideas. Without advanced ideas, there will naturally be no new talent training mode, which is worthy of our in-depth consideration.

Take bioinformatics as an example to make a concrete analysis. Since the implementation of the Human Genome Project in the 1990s, biology, especially molecular biology, is undergoing a major change, from the biology that only focused on one gene or one protein in the past to the new system biology. By identifying tens of thousands of genes and millions of single nucleic acid polymorphisms, genomics will help reveal the root of the problem and find the best treatment for many genetic diseases. The wave of "genomics" such as genomics, transcriptomics, metabonomics and proteomics is promoting this change. This is a great opportunity to give birth to new frontier disciplines and grow new academic leaders. However, many graduate students in this field can’t adapt to this change. Where is the problem? Professor David R. Brown (Professor of Pharmacology, Neuroscience and Toxicology) of the University of Minnesota in the United States thinks that "part of it is an education problem" because we are training pharmaceutical workers who are aware of the progress of genomics and proteomics? Are we training molecular biologists who will participate in the process of drug discovery? Neither. In this new discipline, molecular biologists and drug workers should not only become information scientists, but also the information among genomics, proteomics, physiology, medicine and biochemistry must be mutually convertible, which is the significance of the discipline of "bioinformatics or In Silico".

People of insight, advanced universities and professors in the United States, Britain and Japan quickly seized this field and trained talents in this new discipline with new teaching contents. The new graduate team also vigorously promoted the development of this field. It has become the consensus of some first-class universities that professors should train a group of new people according to the requirements of the frontier of science and the needs of the future, and corresponding management methods have been developed for many years.

If we just think that this is an interdisciplinary problem, I think it is not enough. Education should really carry out the idea that education should face modernization and the future.

Today, with the rapid development of science and technology, the development of science and technology provides a great opportunity for China’s economic development, and also provides a great opportunity for China’s science and technology to catch up. But why is it that China’s innovation ability has been difficult to improve compared with the world, and it has long lacked real talents and masters? I’m afraid it’s not that our intelligence in Chinese is insufficient. I think part of the problem lies in education, especially postgraduate education.

Tsinghua University celebrated Teachers’ Day in 2015.

Viii. Bioinformatics-Opening up New Fields

Around 1996-1997, the human genome project was in full swing, and a large number of genome data emerged. Being very sensitive to "data", I naturally wouldn’t miss such an opportunity.

The diagnosis and treatment of diseases is moving from reductionism to system theory.

Our diagnosis and treatment of diseases is moving from reductionism to system theory. At present, most of the research on life science still stays in local details. In the future, the study of life science should rise to a holistic and systematic height, because life is a whole. We need to combine micro and macro! The Human Genome Project has brought our analysis of the human body system into the gene level and an unprecedented field. In order to understand the occurrence of diseases, we are eager to understand the function of genes and protein. However, with the exception of a few genes and protein, most genes and protein do not work alone. Most genes and protein often interact with each other, and their relationship is like a very complex network.

We are faced with the following problems: searching for genetic variation that leads to genetic diseases in complex biomolecular networks, searching for drug targets for treating diseases or symptoms from gene protein networks, and then searching for cancer markers.

How to analyze this network? We can’t break up the network and analyze it in multiple parts, but we must analyze it as a whole; However, usually we only know a small part of this complex network. How can we analyze the role of genes or protein from a part of the network? This problem has been bothering us for nearly ten years!

2 Correlation analysis-relationship inference is a breakthrough.

Correlation analysis is a breakthrough! The early breakthrough of this problem lies in finding mutant genes of non-familial genetic diseases. For familial genetic diseases, we can find the corresponding family and find its special gene mutation through linkage analysis; However, for non-familial genetic diseases, traditional methods are no longer applicable. In desperation, people have come up with correlation analysis: simultaneous occurrence is correlation.

Divide patients and healthy people into two groups, and find gene mutations that appear in patients but not in healthy people. These gene mutations are "related" to genetic diseases. Of course, it is not enough to find the related gene mutation, but also to confirm the truly disease-related gene mutation through prior knowledge, mechanism analysis, experimental verification and other methods, preferably through independent verification by a third party. Finally, this method was proved to be feasible, and with the continuous expansion of the experimental population, it was extended to the whole genome analysis and achieved remarkable results.

We further expand the correlation analysis into relationship inference and propose the CIPHER algorithm. We assume that phenotypes are more similar and related genes are closer, that is, "the distribution of phenotypic similarity" is consistent with "the distribution of gene proximity". Given a phenotype, we can find the corresponding genes. The key of this method is to combine the macro and micro, and to connect the characterization with biomolecules. By using the phenotypic correlation, we can find gene mutations with similar phenotypes from known phenotypes, and we can find drug targets for diseases. By using the "relationship inference" method, we have succeeded in some applications.

The change of diagnosis and treatment of diseases from reductionism to system theory is a major development of medical undertakings, which is of great significance to early diagnosis of diseases, precise medical care and drug research and development. Substantial progress has been made in this regard.

2010 Xining-Lhasa Bioinformatics Symposium

3 big data is more about big data.

Relationship inference enables us to understand the meaning of big data more deeply-to provide all aspects of "relationships", which plays a key role in solving complex system problems!

There are a lot of omics data in molecular biology, and there are also a lot of data on diseases and medicine, which is a veritable big data; However, when we search cancer data, we find that the sample size is very small, because even if they are both liver cancers, there are many subtypes, because there are many possible combinations of mutations, and they are closely related, but they are not samples of the same class; What big data gets is actually a high-dimensional small sample, which is "relationship" big data! It is precisely because of the "relationship" provided by big data that relationship inference is of great use. Vigorously developing relationship inference is very important for the prediction and intervention of biological system, social system, social system, financial system, economic system and military system.

Today, science and technology have experienced Newton’s mechanics, Einstein’s theory of relativity and quantum mechanics. It seems that they have developed very richly and profoundly, and mathematics has developed perfectly, with more and more branches of science becoming more and more specialized. When science seems to be omnipotent, when people really face the complex world, they suddenly find that all science and technology are so limited and simple; When people explain the world with the perfect law, they find that they often run into a wall, and the contingency of world development is so great! What the hell is going on here? Now, even the basic problems, people are shaking their faith in the past "truth". For example, how did the universe come into being? Did organisms evolve according to Darwin’s theory of evolution and the principle of survival of the fittest? What is the secret of life? And so on, this is really a wonderful era. In my opinion, the boundaries of various disciplines are becoming more and more blurred, and interdisciplinary subjects have become the fastest-growing disciplines. With the development of computers, the realization of the human genome project, the emergence of global networks and the high-speed exchange of information, the science and technology of human society are developing at an unprecedented speed, and we are facing a new era of science. Random and nonlinear new analytical methods are making great and even fundamental changes in the analytical methods and conclusions of various disciplines in the past. This is a golden age that provides great opportunities for people engaged in scientific exploration! We are living in such a lucky era. In this era, we dare to imagine and be good at cross-research.It is very important to dare to grasp things in essence and in general. Only in this way can we seize the opportunity of this era to the maximum extent and be worthy of this era. I hope such talents will appear more in the East and in China.

Read the original text

Column web address