A number of banks announced: pause!

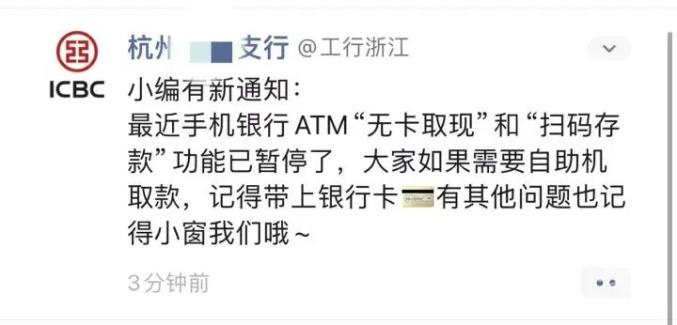

Recently, Mr. Lu, a citizen of Hangzhou, received a message: "Recently, the functions of ATM‘’s’ cash withdrawal without card’ and’ code scanning deposit’ in mobile banking have been suspended. If you need to withdraw money from self-service machines, remember to bring your bank card." When he talked to his relatives and friends around him, he found that many people had received similar notices during this period.

A number of banks announced the suspension of card-free deposits and withdrawals.

According to Securities Times. com, in recent years, many state-owned banks and joint-stock banks, such as Bank of China, China Construction Bank, China Everbright Bank and China CITIC Bank, have announced the suspension of card-free deposit and withdrawal related businesses.

Recently, the Bank of Communications announced that in order to promote high-quality business development and strengthen risk management, the reservation withdrawal service in the card-free withdrawal function of personal mobile banking will be stopped on May 24, 2024. Customers can still apply for card withdrawal, code scanning withdrawal or go to bank outlets to apply for withdrawal business through Bank of Communications intelligent machines.

It is understood that customers can make an appointment for "card-free withdrawal" on the mobile banking of Bank of Communications before, and preset the reservation verification code and reservation amount when withdrawing money without a card. After making an appointment, they can withdraw money at the bank ATM without a card.

Before Bank of Communications, another state-owned bank, Agricultural Bank of China, suspended the card-free withdrawal service of its mobile banking, but customers can still handle the related business of cash withdrawal at outlets by means of card reading, palm-scanning code withdrawal and face-brushing withdrawal.

In addition, CITIC Bank also cancelled this business this month. CITIC Bank announced that "the cash self-service equipment authorization code withdrawal function has been closed on May 17th".

Related business has been tightened for nearly two years.

Since August 2022, some banks have tightened the card-free deposit and withdrawal service.

According to the announcement issued by China Construction Bank, the reason why the bank deployed the two-dimensional code deposit function of ATM is to improve its service ability to cardholders. After this function is turned off, customers can choose to open the service of "face brushing" to handle ATM deposits. In addition to China Construction Bank, China Bank, China Guangfa Bank and China CITIC Bank have also announced that they will stop the deposit function of ATM QR code.

The reporter noticed that although the card-free deposit and withdrawal service has been tightened, most banks do not directly shut down the card-free cash business of self-service equipment, and services such as scanning code deposits and "brushing face" deposits can still be used. For example, at present, the mobile banking APP of China Merchants Bank can still use the scanning code deposit and withdrawal service, and the QR code withdrawal service does not need a physical card. The mobile banking can scan the QR code generated by ATM, then specify the card number and amount, and enter the withdrawal password on ATM to complete the transaction, with a single card limit of 20,000 yuan per day; Scan code deposit is limited to 50 thousand yuan, and can only survive.

"The ATM equipment of our bank can scan the code to withdraw money, and the scan code deposit needs to be handled by moving the counter." The staff of a branch of ICBC told the reporter that the bank’s self-service equipment can still carry out code scanning and withdrawal service, and it can be operated by scanning the code with the mobile banking APP and entering the withdrawal password. However, the code scanning deposit function of the self-service equipment has been cancelled, and it is now used as a way of counter-free transaction, which is suitable for customers who apply for deposits but do not carry ID cards or physical cards.

"If customers apply for deposits without cards, they can use ID cards or mobile banking scanning codes at the counter, and both methods are verified by the system for face recognition." The staff of a certain branch of ICBC mentioned above suggested that there is a difference in the amount of deposit and withdrawal between them. The ID card can handle the deposit and withdrawal business of less than 200,000 yuan, while the mobile banking can only handle the deposit and withdrawal business of less than 50,000 yuan.

More banks may keep pace.

The reporter combed the announcements of relevant banks on adjusting the card-free deposit and withdrawal business and found that risk management, cost reduction and optimization of financial services have become high-frequency words.

Wang Pengbo, a senior analyst in Broadcom’s financial industry, said that the tightening of card-free deposits and withdrawals of self-service devices was mainly due to user usage and security considerations.

"It is convenient and fast to deposit and withdraw money on self-service devices through mobile banking, and it is easy to be used by criminals." A bank employee told reporters that although most banks’ mobile banking regulations are limited to their own custody and use, cases of lending and buying and selling mobile banking have occurred from time to time.

Wang Pengbo said that the operation process of QR code deposit itself is cumbersome and the convenience of use is not enough. At the same time, the ATM QR code deposit business may not be able to accurately identify the depositor’s identity and confirm the relationship with the payee. In addition, the source and use of funds are hidden, which will make it more difficult for banks to monitor money laundering activities.

Wang Pengbo predicted that more banks will follow up and adjust the card-free deposit and withdrawal business in the future. "The bank deposit and withdrawal business should focus on security, and at the same time meet the principles of identity verification and unity of time and space."

Have you ever used the card-free deposit and withdrawal function?

What do you think of this?

Original title: "A number of banks announced: pause! 》

Read the original text