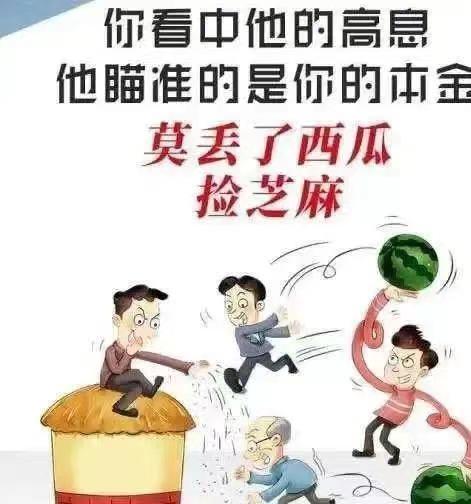

Don’t touch illegal fund-raising, and bear the economic losses yourself! Prevent illegal fund-raising and popularize knowledge, and dry goods are full!

What is illegal fund raising?

Article 2 of China’s Regulations on Prevention and Disposal of Illegal Fund-raising stipulates that illegal fund-raising refers to the act of absorbing funds from unspecified objects by promising to repay the principal and interest or giving other investment returns without the legal permission of the State Council’s financial management department or violating the national financial management regulations. The term "the State Council financial management department" as mentioned in these Regulations refers to the People’s Bank of China, the State Council financial supervision and management institution and the State Council foreign exchange management department.

What are the characteristics of illegal fund-raising?

Illegality: absorbing funds without the approval of relevant departments according to law or in the form of legal operation;

Openness: Publicize to the public through the media, promotion meetings, leaflets, mobile phone messages, etc.

Inducement: promise to repay the principal and interest or pay the return in the form of money, kind, equity, etc. within a certain period;

Sociality: absorbing funds from the public, that is, unspecified objects in society.

Participation in illegal fund-raising is not protected by law.

The government doesn’t pay the bill!

Article 25 of the Regulations on Prevention and Disposal of Illegal Fund-raising stipulates: "The participants shall bear the losses incurred by participating in illegal fund-raising activities." That is, if the illegal fund-raiser and the illegal fund-raiser still have losses after repaying the funds to the fund-raiser according to the principle of "chasing after all" and "returning after all", the fund-raiser shall bear the losses by himself. Losses suffered by participating in illegal fund-raising activities shall not be passed on to state-owned banks, other financial institutions and any other units that have not participated in illegal fund-raising activities. This means that once the public participates in illegal fund-raising, their interests are not protected by law, and the government, relevant departments and judicial organs may not be required to bear the losses.

Common routines of illegal fund-raising

Illegal fund-raising criminals in order to lure the masses to be deceived and achieve the purpose of illegal fund-raising, usually take the following measures to defraud the masses of trust:

First, draw cakes to attract attention

First of all, fund-raisers will weave one or more projects as high as possible, and paint a blueprint with rich expected returns under the guise of "new technology", "new revolution", "new policy", "regional chain" and "virtual currency", so as to "hang up" investors’ appetite and make them "not to be missed" and "now or never" Fund-raisers usually draw "cakes" big to attract investors’ attention as much as possible.

Second, first give the sweetness to attract investment

In order to make you invest more money, criminals often give out "dividends" in full as scheduled in the early stage, so that you can feel that this investment is reliable and real, and you can actually get money. In fact, all this money is borrowed from the old, even the money you invested yourself, which is simply impossible to last. His purpose is to make you increase investment, take a long-term view, catch big fish, and then rob Peter to pay Paul, use the money of later generations to cash in the previous principal and interest, and then secretly transfer funds and abscond with the money after reaching a certain scale.

Third, impress and seduce through acquaintances

In some cases of illegal fund-raising with the elderly as the main development goal, criminals often seize the old people’s sense of holding a group and herd mentality. Some old people can’t help but participate when they see their acquaintances who have voted and earned money. This is their trap. Often, the victims in a case have some relationships, such as relatives, friends, neighbors, etc., and even some criminals get close to the old people in the form of "recognizing relatives", which leads to being cheated.

Fourth, false propaganda confuses the public

Use all resources to make the momentum bigger. Fund-raisers usually hold various publicity activities, such as press conferences, product promotion meetings, on-site observation meetings, experience days, knowledge lectures, etc. A large number of "technical certifications", "award certificates" and "government approvals" that are true or false are displayed; Publish some video materials inspected by leaders, and take photos with government officials and stars; Deliberately selecting the event in the government conference center and auditorium is extremely deceptive because of its large scene and high specifications.

Five, confuse the concept of stealing investment

The criminals blew the listing in the local stock exchange center into listing, and confused the listing in the American OTCBB market with listing on NASDAQ; Some use new terms such as electronic gold, investment funds and online speculation to confuse the masses and pretend to be new investment tools or financial products; Some use monopoly, agency, franchise chain, consumption value-added rebate, e-commerce and other new business methods to deceive the people to invest.

Be careful when you encounter the following 11 situations.

1 to invest in the pension industry can get high returns or reserve beds, pre-existing membership fees can get income from pension as a cover;

2. Under the guise of private equity and partnership, but not for enterprise industrial and commercial registration registration;

3. Under the guise of "watching advertisements and earning extra money", "consumer rebate", "charity", "mutual aid", "virtual currency" and "blockchain";

4. Under the guise of investing in overseas equity, options, foreign exchange, gold, futures, etc., especially encouraging the development of others and giving them a commission, some hold "investment" promotion conferences in overseas high-end hotels such as Hong Kong, Macao and Taiwan and Southeast Asian countries;

5. Obviously beyond the business scope of company registration, especially without the qualification to engage in financial business;

6. The company’s website and server are located overseas or the company’s executives are foreigners, making false propaganda;

7. The company’s website is not formally filed, or the website name and investment projects are frequently changed;

8. Require the payment of investment funds in cash, or transfer funds to personal accounts or overseas accounts;

9. Promise ultra-high rate of return, especially promise "static" and "dynamic" returns;

10 gifts to attract the elderly by organizing inspection, tourism, lectures and other means;

11 in the streets, supermarkets, shopping malls and other places where people flow and gather, set up stalls and distribute advertisements of "wealth management products", especially for middle-aged and elderly people.

What should I do if I encounter illegal fund-raising?

There are seven steps in total:

1. Verify the industrial and commercial registration. Inquire about the industrial and commercial registration materials through the enterprise credit information publicity system to find out whether the relevant enterprises are legal enterprises registered through legal procedures. If the corporate identity is illegal and untrue, it is fraud.

2. Look at the return on investment. Compared with whether the interest rate of bank loans and the return rate of ordinary financial products are too high, the obviously high return on investment is likely to be an investment trap in most cases. According to the law, the annual interest rate of private lending exceeds 24% and is not protected by law.

3. Check relevant information. Through the website of the government’s main (supervisory) department, we can inquire whether the relevant enterprises are listed companies approved by the state, whether they can issue company stocks and bonds, and whether they are equity trading places stipulated by the state. If they do not have the main qualifications to issue and sell stocks, sell financial products and carry out deposit and loan business, they are suspected of illegal fund-raising. If criminals promote the so-called stocks to be listed in domestic and foreign securities markets in the name of "securities investment consulting company" and "property rights brokerage company", they can check whether the issuance has been approved through the government website.

4. See if it is operated in the sun. Many illegal fund-raising behaviors are hidden. They introduce each other through relatives and friends, and then develop offline, forming a network to absorb funds. They do not sign formal contracts, nor issue credentials, and promise rebates, but they do not fulfill their promises; Or compiling so-called "good projects" dare not sell them publicly in the market, but operate underground to lure people to buy them. The general public must adhere to the sunshine operation when investing in financial management, which financial products are publicly sold in the market, and must not participate in "black market transactions".

5. Know where the investment funds go. Formal investment projects clearly explain the purpose of absorbing funds, and investors can also understand what their money has done. As for the funds absorbed by illegal fund-raising, it is difficult for depositors to know what the money they invested has done and where it has gone.

6. Pay attention to and inquire about media reports. Some influential illegal fund-raising cases will be reported by the relevant media. It is necessary to search and query the records of illegal scope of relevant enterprises through media and Internet resources to prevent criminals from repeating them in different places.

7. Consult legal professionals. For low-risk and high-return investment advice to relatives and friends, we should communicate and consult with knowledgeable friends.

Original title: "Don’t touch illegal fund-raising, and bear the economic losses yourself! Prevent illegal fund-raising and popularize knowledge, and dry goods are full! 》

Read the original text