Preventing and resolving financial risks has achieved initial results, and city commercial banks are stable and far-reaching

CCTV News:Preventing and resolving financial risks is the top priority of China’s financial supervision in recent years. Some city commercial banks, which are based in cities and mainly provide loan support for small and medium-sized enterprises, once experienced a situation of high non-performing loan ratio and unsustainable operation due to insufficient financial strength and low market risk tolerance. Local governments and financial supervision departments took a series of innovative measures in time, which successfully resolved the risks.

Liangshan Yi Autonomous Prefecture, located in the southwest of Sichuan Province, is rich in local mineral resources and has nearly 1,000 large and small mining enterprises. In 2014, in the last round of market volatility, the price of iron ore once dropped by 50%, and local mining enterprises were in trouble, and this risk was also transmitted to the financial system.

Lu Ningyuan, head of Liangshan Branch of Sichuan Bank and former vice president of Liangshan Commercial Bank:The vast majority of mining-related enterprises are in trouble, the interest on bank loans cannot be paid, the loans due cannot be repaid, and a large number of non-performing loans (loans) have also appeared in the loans of mining-related enterprises of the former Liangshan Commercial Bank.

Established in 2007, Liangshan Commercial Bank covers 17 local counties and cities. Among its total loans, loans from mining-related enterprises account for a relatively high proportion. This kind of loan structure is in western Sichuan, not only Liangshan Commercial Bank. Almost at the same time, Panzhihua Commercial Bank also experienced a crisis. As a shareholder of Panzhihua Commercial Bank, Luo Yangyong keenly felt that there were problems in bank operation.

Luo Yangyong, Chairman of Anning Iron and Titanium Co., Ltd.:When dividends were gone, bad debts and bad debts gradually increased. Other indicators have also deteriorated seriously, and we feel that the investment will fail, and it is estimated that we will lose all our money. All the shareholders are worried, but they are helpless and don’t know how to do it.

It never rains but pours. The guarantee company, which should have provided guarantee for the mine-related enterprises in the loan process, has not played its due role.

Today, many parties admit that in this process, banks themselves also had problems such as inadequate risk management and control. When the risks were exposed, even though Liangshan Commercial Bank and Panzhihua Commercial Bank, two city commercial banks, took various measures to deal with non-performing assets to resolve the risks, the non-performing assets continued to climb. By 2019, the total balance of non-performing assets of the two banks will be nearly 30 billion yuan. Among them, the non-performing loan ratio of Panzhihua Commercial Bank was as high as 53.4%, while the average non-performing loan ratio of 134 city commercial banks nationwide was only 2.3% in the same period.

Nearly 30 billion yuan of non-performing assets and more than 50% of non-performing loan ratio, once not properly disposed of, the consequences are unimaginable. Faced with such a huge challenge, the Sichuan provincial government and financial supervision departments decisively intervened, merged two high-risk municipal city commercial banks and established a new provincial bank.

As the chairman of Sichuan Bank, Lin Gang participated in the risk resolution of Liangshan Prefecture Commercial Bank and Panzhihua Commercial Bank and the establishment of Sichuan Bank. He told reporters that the working group faced many difficulties as soon as it was established in 2019.

Chairman of Sichuan Bank Lin Gang, former director of Sichuan Bank’s preliminary work promotion group office:The first is the problem of how to resolve and digest the bad assets of these institutions on such a large scale.

After a thorough investigation of non-performing assets, in February, 2020, the Working Group launched a 60-day battle to clear and close non-performing assets in Panzhihua, Chengdu and Liangshan.

Zheng Ye, President of Sichuan Bank and former Deputy Director of the Office of the Pre-work Promotion Group of Sichuan Bank:It is very, very difficult to collect interest from one household, collect the bad loans they owe, and increase the collateral of loans from one household to another.

While collecting and transforming some non-performing assets, the working group adopted the strategy of digesting part of the old shareholders’ equity at a discount, keeping part of the books, packaging and stripping part, and the new shareholders taking part. With the decrease of non-performing assets, a more intractable problem has surfaced.

Zheng Ye, President of Sichuan Bank and former Deputy Director of the Office of the Pre-work Promotion Group of Sichuan Bank:In the bank, the shareholder himself has a record of breaking the law and needs to be cleaned up. If the shareholders have non-performing loans in the bank, you can either pay off the principal and interest of your non-performing loans or pay off your shares to repay the non-performing loans. There is another problem: the shareholder’s loan exceeds the requirement of regulatory concentration, and he should also bear the responsibility and correct it.

With the vigorous promotion of local government departments, the two banks cleaned up and rectified 258 old shareholders. In order to prevent the same problem from appearing again, the supervision of the new shareholder team must also keep up. The working group hired external professional institutions to formulate strict plans for the bank’s internal processes and governance structure.

Wu Weijun, Vice Chairman of Deloitte China:As a shareholder of a bank, I have a responsibility, not to say that this bank is mine, so I can trade at will. Any shareholder’s transaction with the commercial bank he has invested in is a related party transaction from the perspective of our accounting, and it should be disclosed. In this risk prevention, we signed an agreement with shareholders to follow the regulatory requirements.

The newly established Sichuan Bank has a registered capital of 30 billion yuan, and the share price is 1.3 yuan/share, of which 1 yuan/share is the share capital and 0.3 yuan/share is the premium fund, and the premium part is specially used for the disposal of non-performing assets. At that time, the valuation P/B ratio of listed banks in China was around 0.8, and the P/B ratio of Sichuan Bank was 1.3. It was a great challenge for the working group to raise enough funds.

Chairman of Sichuan Bank Lin Gang, former director of Sichuan Bank’s preliminary work promotion group office:At that time, to be honest, we were all worried about the uneven fundraising. In the end, the capital raised was about 34.8 billion yuan, and 4.8 billion yuan was returned. Some shareholders did not come in. Sichuan Financial Holdings, as the main sponsor, holds a lot of 20%, a few percent and a few percent. Therefore, from the perspective of the market dispersion of shareholders, it should be said that it is more reasonable.

On November 7, 2020, Sichuan Bank opened its doors for business. After two years of risk mitigation, it achieved initial results.

Chairman of Sichuan Bank Lin Gang, former director of Sichuan Bank’s preliminary work promotion group office:From the quality of its assets, the non-performing (loan ratio) has dropped from the original high to about 2.08% at the end of April, and our goal is to drop below 2%, so I think this is a very, very good thing.

The establishment and steady operation of Sichuan Bank has explored a new path for the regulatory authorities and local governments to resolve the operational risks of city commercial banks, and Shanxi and other places are also resolving the risks of city commercial banks through similar models.

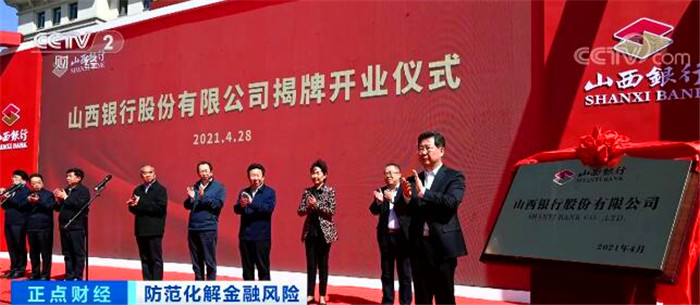

On April 28th this year, Shanxi Bank officially opened to the public. Shanxi Bank was formed by the merger of five original city commercial banks: Datong Bank, Changzhi Bank, Jincheng Bank, Jinzhong Bank and Yangquan City Commercial Bank.

Ceng Gang, Deputy Director of National Finance and Development Laboratory:It is not a simple merger. During the merger process, it has a lot of institutional mechanism optimization to enhance its long-term development ability. In fact, it is not only capital injection, but also wisdom injection, so as to improve the management ability and management concept.

According to industry insiders, there are currently three main modes for risk resolution of city commercial banks — — Bankruptcy, short-term rescue and merger and reorganization have indeed played a role in stabilizing local economic development and maintaining the stable operation of the financial system.

Xing Guijun, Director of China Banking and Insurance Regulatory Commission City Banking Department:After more than three years of efforts, the risk preference of city commercial banks has been gradually revised, the extensive business model has been gradually reversed, the business behavior has become increasingly standardized, the risk level has continued to converge, and it has gradually changed to high-quality development.

In addition to resolving risks of city commercial banks, rural commercial banks and high-risk trust institutions, China Banking and Insurance Regulatory Commission has made positive progress in dismantling high-risk shadow banks and strengthening credit risk prevention and control. From 2017 to 2020, the cumulative disposal of non-performing loans was 8.8 trillion yuan, exceeding the sum of the previous 12 years, and the scale of shadow banking dropped by about 20 trillion yuan compared with the historical peak.

Liang Tao, Vice Chairman of China Banking and Insurance Regulatory Commission:A number of city commercial banks and rural commercial banks have made positive progress in risk resolution. At the end of the first quarter (2021), the balance of non-performing loans in the banking industry was 3.6 trillion yuan, and the non-performing loan ratio was 1.89%, down 0.02 percentage points from the beginning of the year.