Introduction: The ultimate marketing of Tank 300 is once again used in the release of new cars.

In many people’s minds, cross-country has always been a symbol of freedom, rudeness and strength, while tank 300 is just like an "old gun" compared with the title of "big brother".

Tank 300 has never stopped in the footsteps of "pleasing" the young consumer market with huge potential.

When the first "young" tank 300 off-road vehicle entered the market, the preservation rate was over 70%, which was more valuable than the Porsche Cayenne.

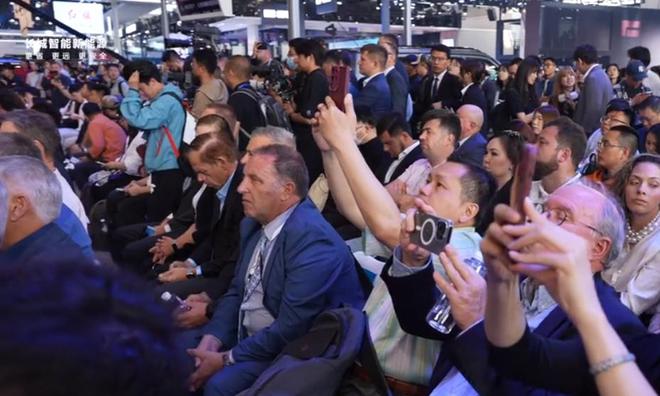

In 2024, the tank 300Hi4-T showed the speed of being sold out when it went on the market. Is this really powerful or another extreme marketing?

Tank 300Hi4-T

Pure electric endurance was questioned.

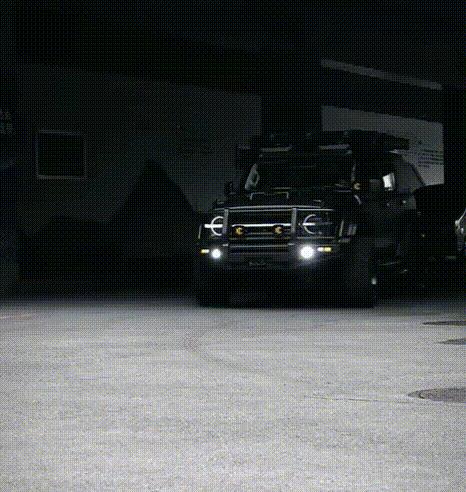

It is said that driving is more comfortable than overbearing, and its value is not lost to herdsman. It is based on a non-loaded body.Tank 300Hi4-TAfter being listed on April 22nd, the car has been sent to all parts of the country one after another, and many car owners have got the car and started using it.

As a tank 300Hi4-T born under the impact of new energy wave,When it comes to this car, there will always be some people who are anxious, not angry, but anxious.

Because this car has been approved by the Ministry of Industry and Information Technology as early as the end of last year, it has been delayed until this year.

The picture shows the photo of the tank 300Hi4-T.

So that some car owners describe it"When the dog finishes eating noodles, when the fire breaks the lock, when the chicken pecks the rice, finally wait for the tank 300Hi4-T".

No wonder fans can’t wait, because as the "new younger brother" of the 300 big families of tanks,Its performance is not at all younger brother.

It is no exaggeration to say that before the listing, some car bloggers put down their rhetoric."As long as the tank 300Hi4-T goes on the market, there will be no other off-road vehicles, and all of them will become soy sauce."

Indeed,As a hard-core off-road vehicle tank equipped with a 2.0T plug-in hybrid system, 300Hi4-T.It can be said that the hanging mode is turned on.

Because when the off-road system combines the advantages of internal combustion engine and electric motor, it can not only retain strong power,It also makes up for the shortcomings of the fuel consumption problem of the tank 300.

Therefore, this provides more choices for some car owners who like off-road vehicles but are worried about fuel consumption.

The sale of this car,It can be said that it also symbolizes the vigorous ambition of tank 300 to enter the new energy track.

Although the official defines the new car as a full-scene off-road new energy SUV, from the appearance,There is basically no change from the traditional fuel car version.

As always, it continues the appearance of a hard-core off-road vehicle with great recognition.The iconic round light group and silver grille have been preserved.

If you really want to study it carefully, it is probably only the color of the car body and the car body size of 4760/1930/1903 mm."Mobile" looks more like an SUV pie.

In addition to the official information, it is equipped with a 37.1kWh battery pack, with a pure battery life of 105km, a comprehensive battery life of 860km and an external discharge of 3.3kW.

You can also manually select the four-wheel drive mode., that is to say, when driving on normal roads, you can choose to compare2H mode with low fuel consumptionThe vehicle can run quietly and smoothly.

When the road surface is abnormal (off-road),You can choose the 4H/4L mode.Release the surging power to deal with all kinds of steep slopes, swamp sand or rugged roads.

I have to say, this market opened up at once.Tank 300 is finally no longer limited to off-road demand.It has brought more surprises to the fans.

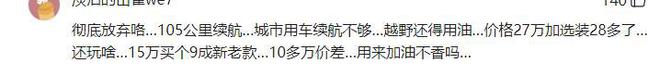

Although the price is between 279,800 and 289,800 yuan.It is much more expensive than the fuel version of the tank 300 that went on sale in 2020, but the heat of this car is not lower than that of the tank 300 at all.

Despite being questioned by netizens"The endurance of 105 kilometers is not enough for city cars, and it is still as high fuel consumption if it is off-road."

But after all, the original intention of the tank 300 Hi4-T was to make up for the short fuel consumption of the tank 300 off-road vehicle. I thought that the tank 300 Hi4-T had not been officially listed.It has already been ridiculed by fans that it is no longer a "partner of the gas station".

Therefore, to a large extent, the tank 300 Hi4-T only needs to cater to the owners who have a special liking for off-road vehicles.

Because car companies that don’t know how to market are not good cars, the slow listing speed of tank 300 Hi4-T has actually accumulated a certain primitive heat for it.

And the "hunger marketing" with a limit of one car per account, a non-refundable deposit and a start of 3,000 cars.The routine of "if you don’t buy it, you won’t have it" really satisfies the consumer psychology of off-road vehicle owners.

It can be said that as a subsidiary of Great Wall Motor, high flyersThe brand-new masterpiece of Tank 300 brand.

Tank 300 Hi4-T is rare in the market."Hard Off-road+Plug-in Hybrid"It really played its own king-fried combination, once again leading the new trend of off-road.

In fact, in addition to the research and development capabilities and innovative concepts of the tank 300,In order to get the title of "the first hard-core off-road vehicle for young people",The marketing road we have taken is also talked about by car fans.

It is not too much to say that the domestic mass cross-country culture began with the tank 300.

Turn the minority into the public, from "wild" to "city"

Tank 300 staged textbook teaching

Tank 300 has made more than a little effort behind the scenes for this title, which can be said to be a bit terrible.Strive to make fans willing to be "cut leeks" by it.

Speaking of tank 300, the faults that off-road vehicle fans can find are basically tactical.Even the average space, comfort and fuel economy can only be regarded as a slight illness of the tank 300.

Then why is tank 300 so capable that fans can not like the Great Wall system but only have a soft spot for it?

It can be summed up in two words: style.

For example,Why can Mercedes-Benz Big G impress many high-net-worth people who originally wanted to buy Cayenne or even Tim Yue?After all, I’ve never seen anyone drive a big G to cross-country.

In fact, to put it bluntly, it is poetry and distance. Mercedes-Benz G is different from other luxury cars symbolizing the status of the rich, and it is more like a combination of "tough guy and evil sister".

But you don’t have to be able to afford a luxury car to have poetry and distance.The working class also needs a free world., so the meaning of the existence of tank 300 came.

After all, you can buy a tin car with a bite of your teeth.Buy a solid girder +2T turbine +8AT gearbox+tank 300 series with one or three locks.

When it comes to cross-country, the tank 300 is a bearer. When it is not cross-country, the tank 300 is a symbol of tough and free taste.

Is the smell of brand positioning and marketing coming out?

Tank 300 first puts its body in the direction of "pseudo-niche"Then, through the influence of such groups and the influence of brands, we can enter the blank market step by step.

Why is it a "pseudo minority" group? Because compared with the saturated mass market,The "pseudo-minority" group has more cohesion.

Here, you can refer to Archaeopteryx, Angpao and lululemon, three middle-class three-piece suits that started as "pseudo-niche".

Their most successful point is that they all caught the middle class representing "urban white-collar workers", and on the one hand, they lacked holidays, health and exercise because of work problems.

On the one hand, it is extremely necessary to use such image objects to symbolize the pain point of having a high-style life ability.In a short time, I have many loyal users with high stickiness.

From the video or photos shared by the owner of the tank 300,Almost all painting styles are all kinds of life fragments such as pursuing freedom, being far away, fighting for the end of the world and camping life.

Therefore, the unofficial standard companion of tank 300 basically belongs toHave money in hand(can withstand huge fuel consumption),There is light in one’s eyes(I have time to be crazy),Ability to pursue poetry and distance.People like this (who have savings and don’t worry about not having food).

And the owner who can afford the tank 300 will naturally be advertised as such an image. After all, a monthly salary of 6,000 yuan and a monthly expenditure of 2,000 yuan on a car with high fuel consumption are not enough.

And what you can’t get is easy to stir.The most brilliant thing about tank 300 is that,Through their own pricing, this time, no matter whether they have money or not, they can "take it all at once".

Because the listing of Tank 300 not only shows the true "iron man tenderness" through the tough guy’s appearance and soft interior,It also directly pulled the off-road vehicle from nearly one million to about two hundred thousand.

Let this car really become more than enough for the rich, and the bullet that likes off-road without money can afford it.

The official released the recruitment activity of "Thousands of People Create Officials Together", and participated in activities such as appearance color naming, interior decoration and personality modification.It is even more difficult to grasp the "high net worth demand" of users.

After all, one of the most hidden functions of tank 300 isThe degree of DIY is very high.

In this way, after a meal of output, despite being criticized by netizens."Tank 300 not only copied Ford, but also copied several off-road vehicles from herdsman and pieced them together.".

But it doesn’t affect the tank 300 to shine alone at all.

According to the data compiled by Car Quick Review, the sales volume of domestic hard-core off-road vehicles in April (excluding imported cars) is in the list."Big Brother Bang" is the tank 300 with a sales volume of 5800, which is better than BJ40, and its sales volume is almost twice that of BJ400.

At first glance, this data doesn’t seem surprising, but off-road vehicles are a niche market after all.The achievements made by Tank 300 are actually very difficult.

The second-ranked model is Tank 500 New Energy.That is, the "big brother" of the tank 300Hi4-T mentioned at the beginning of this article can be said to be one of the best-selling high-end new energy off-road vehicles.

There is no doubt that the new energy series of Tank 300 has "made a beautiful start" for domestic new energy off-road vehicles.

And the most exciting news for fans is thatOn February 1, 2024, the 300,000th car of Tank 300 officially rolled off the assembly line.Set a production and sales record of 300,000 off-road vehicles, the first single vehicle in China.

All this is inseparable from the hard marketing of Tank 300. Although excessive marketing will bring visual fatigue, it is better than chaotic marketing.

Speaking of chaotic marketing, Guanzhi can be said to be a representative player.

Baoneng Group will resurrect the Qoros 7 model

Can Guanzhi still get up?

Qoros, which was born in 2007, was another masterpiece of Chery automobile brand. According to China Auto News,In its glory days, it not only submitted nearly 1000 trademark applications, but also obtained about 300 patents.

However, such a high achievement seems to be in great contrast with the state of "applauding and not calling for seats".In 2018, the sales volume was only 63,200 vehicles. By 2019, it was directly cut in half to 22,900 vehicles.

Source: Multiplication Association

And the problems of products, services and channels broke out.

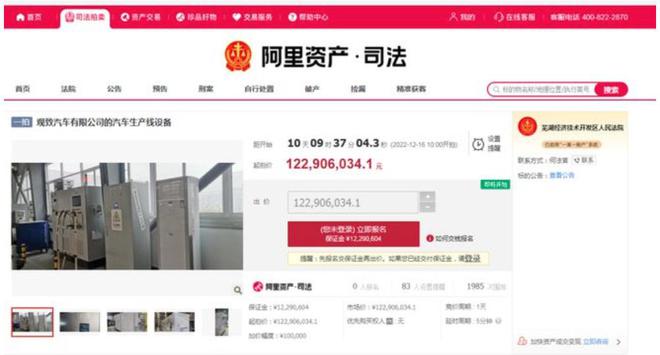

When Guanzhi appeared in front of people again, it began to be labeled as "information of the executed person".As of press time, there were 39 pieces of information about the executed persons of Qoros Auto, and the total amount of execution was 685 million yuan.

And this is largely related to sharing car companies.Poor maintenance, poor management and poor imageRelated to the shared car model, the Qoros brand was completely screwed up in this way.

When Linked Cloud also started to bring goods at low prices, it also directly returned to Guanzhi’s original sales network.Later, various "wonderful" operations pushed Guanzhi to the cliff step by step.

So, this one isGuanzhi born under the background of irrational engineer’s dream of building a carJust disappeared into the automobile market.

Recently, it has been circulated on the Internet that Baoneng Group will resurrect the Qoros 7 model and plan to start producing pure electric vehicles and extended-range electric vehicles in the next 1-2 years. Can it make Qoros "run"?

Automobile consumption has always been a "big item" in the consumption economy of Chinese people, and it has also witnessed the economic development. The development path of Tank 300 has brought more thoughts to the off-road vehicle industry.

Will the environment of the Z generation bring a slight turn for the rejuvenation of off-road vehicles?

Does the brand marketing of cars also need to be more in line with the expectations of car owners? What do you think?Welcome everyone to share messages in the comment area.