Lilly, the world’s largest pharmaceutical company by market value, has reached a new high! There is a huge room for improvement in industrial penetration, and these A-share companies have sufficient g

In 2024,Still hot.

Mu Fengda was approved for listing in China.

On May 21st, National Medical Products Administration official website showed that Mufengda (Telpotide Injection) was approved by National Medical Products Administration (NMPA) to improve blood sugar control in adults with type 2 diabetes.

Telpotide is a GIPR and GLP-1R agonist injected once a week. GLP-1 and GIP are two natural incretins. Studies show that GIP can reduce food intake and increase energy consumption, thus reducing body weight. When GIP is combined with GLP-1 receptor agonist, it may have a greater impact on patients’ blood sugar and weight.

It is worth mentioning that telpotide can produce better weight-losing effect than Smegrupeptide, which is known as the "slimming medicine". Relevant research data show that the weight of the subjects with 5mg and 10mg of Mufengda decreased by 7.8kg and 10.3kg on average, and that of the group with 1mg of Smegliptide decreased by 6.2kg on average.

Regarding the approval of this drug, it is said that the approval of telpotide injection represents a breakthrough in the field of diabetes research and development.

On May 21st, local time, Lilly, which listed on the US stock market, rose by 2.55%, and the latest closing price reached US$ 803.17 per share, a record high. At present, its total market value reached US$ 763.337 billion, making it the highest pharmaceutical company in the world.

There is a large room for growth in the market.

At present, due to the high price of GLP-1 and the low level of patients’ cognition, the penetration rate of GLP-1RA drugs in China is low. This also means that there is a large space for drug penetration in the future. According to the data released by Zhuozhi Consulting, in developed countries in Europe and America, the GLP-1 market has accounted for about 20% of hypoglycemic agents, while in China, the GLP-1 market started late and patients have high price sensitivity, so there is still much room for growth.

According to the GLP-1 Industry Blue Book, the global GLP-1 market will be about US$ 19.85 billion in 2022, and it is expected to grow rapidly to US$ 55.2 billion in 2030, accounting for 57% of the global diabetes drug market.The research report mentioned that GLP-1 drugs have broad market prospects in the field of metabolism. It is estimated that by 2030, the market scale for type 2 diabetes and obesity will exceed 100 billion US dollars.

According to the Insight database,The GLP-1 receptor agonist Smegliptide tablets and injections have been approved for the treatment of diabetes in China. At present, 112 new GLP-1 drugs have entered the clinical stage in China.

Recently, a number of A-share market concept stocks revealed the layout progress.

It is indicated that as of April 27th, 2024, all subjects have been enrolled in the phase II clinical treatment of BGM0504 injection for type 2 diabetes and weight loss indications, among which all subjects in the 5mg dosage group for diabetes indications have been excluded, and one case in the 10mg dosage group has not been excluded.

The GLP-1 product liraglutide injection phase III is currently in the process of clinical trial data collation, and CSR is expected to be completed in September. GLP-1-Fc fusion protein (dulaglutide) is currently in the process of phase III clinical trial data collation, and at least one of the above two varieties will be declared in the second half of the year.

It is revealed that as of May 2, the total amount of contracted orders for liraglutide preparations and various GLP-1 APIs of the company is nearly 600 million yuan, and some orders have been shipped one after another; The preparation production base has obtained GMP certification of the European Union and cGMP certification of the United States.

express,Liraglutide (intended for diabetes indications) is in the phase III clinical trial stage in China. Smegliptide injection and deglutinin injection (intended for diabetes indications) are in the phase I clinical trial stage in China.

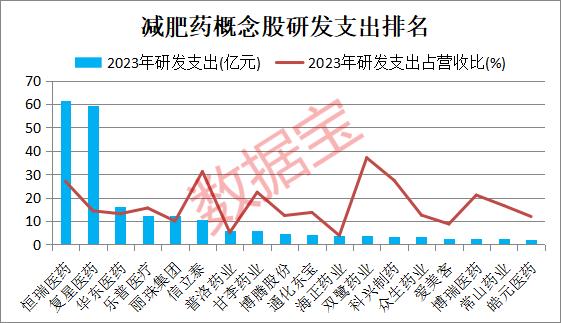

The research and development intensity of diet pills concept stocks is much higher than that of A shares.

R&D needs long-term and high-risk investment. Pharmaceutical companies need strong scientific research strength and financial support in order to develop a product among numerous researches. High-intensity research and development is essential to deus ex in the crowded diet drug track.

according toAccording to the statistics of Times Data Treasure, the total R&D expenditure of diet pills concept stocks in 2023 was 23.858 billion yuan, accounting for 10.26% of the total operating income, and the R&D expenditure accounted for 4.09 times of the A-share level in the same period.

、、、、、The R&D expenditure of six concept stocks in 2023 exceeded 1 billion yuan. Among them, the R&D expenditure in 2023 was 6.15 billion yuan, ranking first; In 2023, the company obtained 72 clinical approvals and 4 generic clinical approvals; Five clinical trials were included in the list of breakthrough treatments.

The future prospects of many diet pills concept stocks are optimistic by the organization. According to the statistics of data treasure, according to the unanimous prediction of more than five institutions, there are 11 concept stocks whose net profit growth rate will exceed 20% in 2024 and 2025. As of the close of May 22, among these concept stocks,、、The rolling P/E ratio is less than 30 times.